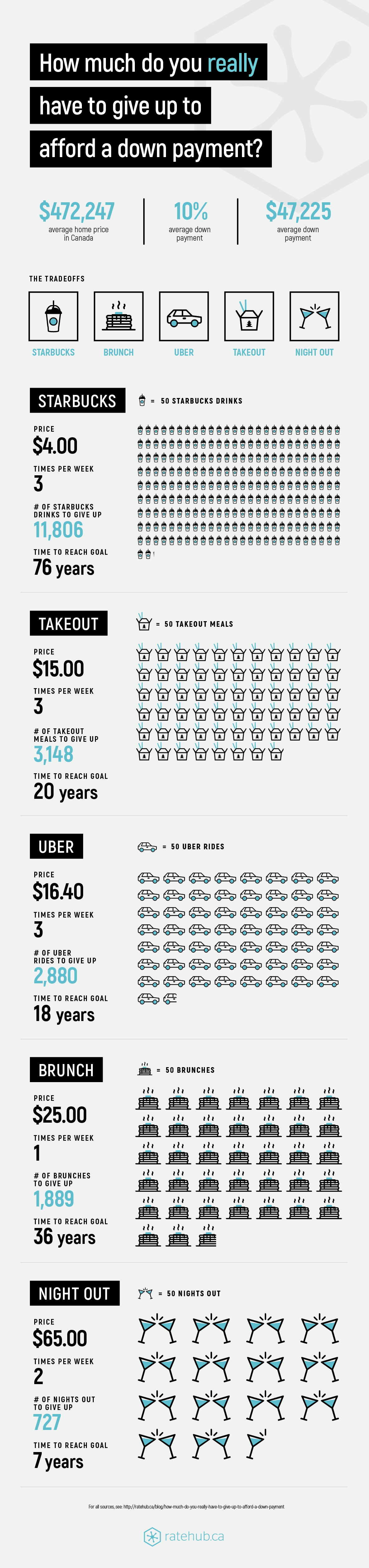

How Much Do You Really Have to Give up to Afford a Down Payment?

In a recent post, we looked at just how unaffordable some parts of the country have become. However, if you have your heart set on owning property, we’ve done some analysis on which everyday luxuries you may have to give up in order to afford a down payment in Canada.

Remember, a down payment is just the tip of the iceberg in terms of the costs associated with owning property. For a full breakdown, be sure to use a mortgage affordability calculator.

Methodology

The average price of a home in Canada was $472,247 in August, according to the Canadian Real Estate Association. And mortgage broker CanWise Financial (a Ratehub.ca company) finds Canadian homebuyers put down an average down payment of 10%.

Using these numbers, we calculated that on average, you’ll need to save $47,225 for a down payment in Canada. From there, we looked at the average price of popular everyday luxuries that people commonly purchase and calculated how much of each you will need to give up to afford the average down payment amount.

What do I have to give up?

If the average price at Starbucks is $4 for each drink (some prefer simple drip coffee whereas others prefer a more elaborate beverage), you will need to forego 11,806 drinks to make a down payment—that’s almost 76 years of no Starbucks if you buy a drink three times a week.

Next up is takeout for those days when you just don’t want to cook. Unfortunately, this too will cost a pretty penny. You’ll have to give up 3,148 meals, or 20 years of cooking at home if we assume that each meal is $15 and you eat out on average three times a week.

How did we even get around before Uber? Some of us have developed quite the habit, with the average ride costing about $16.40. Take an Uber three times a week and you’re looking at 18 years of walking or taking public transit. In other words, that’s giving up 2,880 Uber rides.

Brunch is a millennial favourite. If we assume each brunch runs you roughly $25 once a week, you’ll have to give up a total of 1,889 brunches for a down payment. You’re looking at 36 years of no brunch to save for that little slice of home.

Everyone loves going out and unwinding on a Friday and/or Saturday night, but unfortunately, it’s not cheap. We estimate that your average night out will typically cost at least $65 once you add up the drinks, cover charge, cab, and food. You will have to give up a total of 727 nights out to buy a home to unwind in after those nights out. If you normally go out twice a week, this means it’ll be seven years of staying in and watching Netflix on a weekend night.

By no means are we advocating that you give up all (or any!) of these things, but rather our aim was to put some of these habits into perspective. Dialing back a little on these habits plus saving more aggressively will get you that down payment in no time. If you’re serious about buying property, a good place to start is to use a calculator to determine how much of a mortgage you can afford.

Also read: