Expensive Cities, Part 2: Why Don't Millennials Like Low Interest Credit Cards?

Second in a three-part series looking at the different financial challenges between those living in expensive Canadian cities and those outside of them. The series also explores generational differences within these cities from a personal finance point of view. The data is based on a self-reported survey of 1,208 respondents conducted by Ratehub.ca between May 1-14. Read Part 1 here.

There are several different types of credit cards on the market, but one you choose should be based on your personal preferences and spending patterns. From cash back to travel, low interest or no fee, there’s something for everyone.

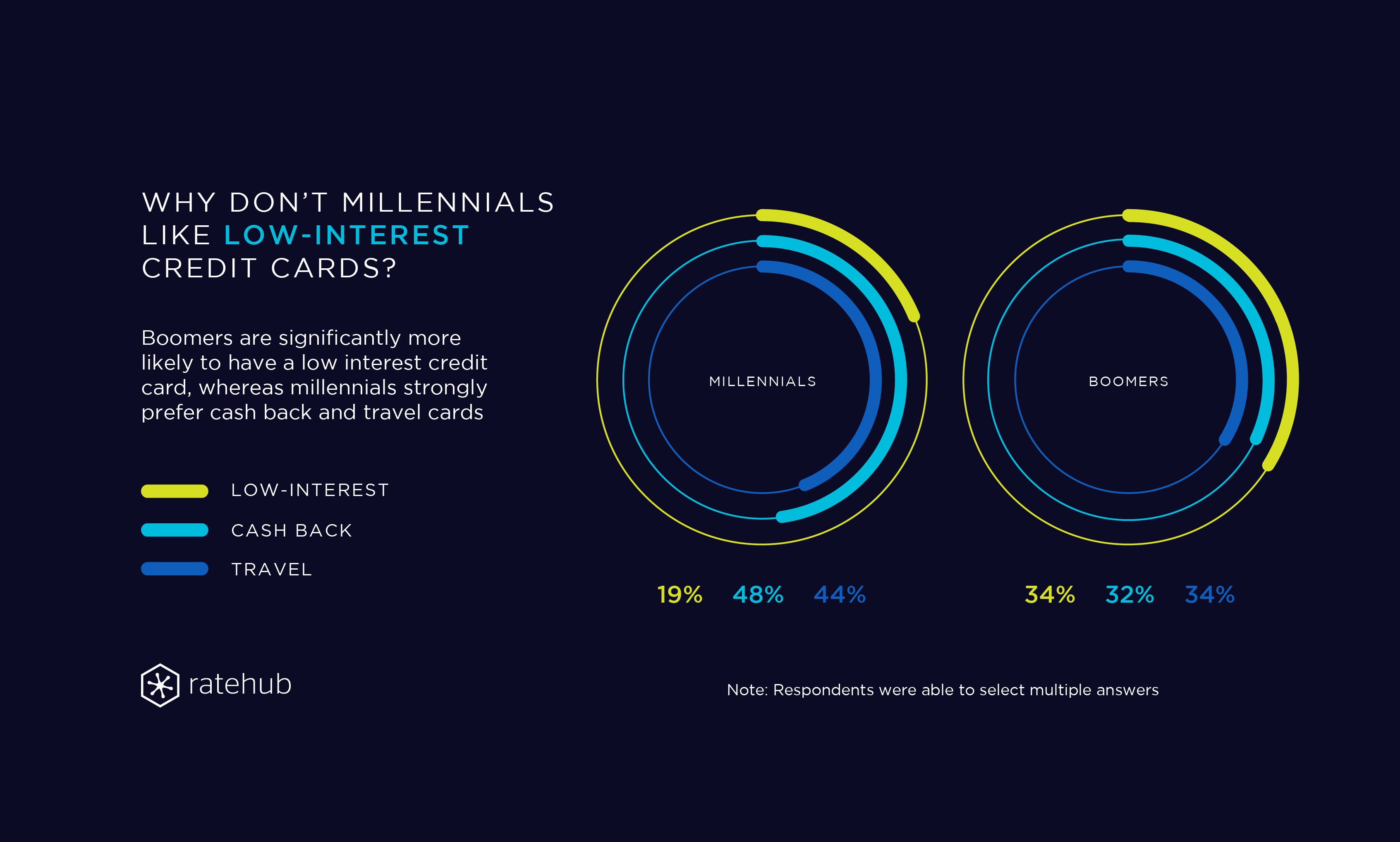

Interestingly, when it comes to credit card use, there are some notable generational differences. The most striking is their choice of credit card: Baby boomers are evenly split between carrying a cash-back, travel, or low interest credit card at roughly 33% each. This is in contrast to millennials, who strongly prefer premium cash back and travel credit cards (48% and 44%, respectively) vs. low interest credit cards, where only 19% of millennials indicated they used it as their primary card.

Why is this the case? Boomers are nearing retirement age (50+), so it’s possible their spending has decreased to account for a lesser income as they transition into retirement. Many premium travel cards have high annual fees ($99 or more) and high income requirements (minimum $60,000 in most cases), so many boomers may no longer qualify or can’t justify the fee. Our data confirms this, with boomers who have low interest cards earning $51,000 annually, vs. those with travel cards earning $62,000, and those with cash back cards earning $54,000 annually.

When it comes to overall comfort with credit cards, millennials are generally more comfortable compared to boomers. Ninety five per cent of millennials have at least one credit card vs. 80% of boomers. Similarly, millennials are more likely to have multiple cards, with 44% of millennials reporting they have two or more cards, vs. only 34% of boomers.

When it comes to credit card use specifically, millennials prove to be more at ease here as well, with 27% reporting they put over 50% of their disposable income on their credit card vs. 16% of boomers. Across all metrics we measured, not only do millennials tend to prefer the premium cash-back and travel cards, but they also tend to be more comfortable with credit cards more broadly, owning more of them, and using them more frequently than their boomer counterparts.

Lastly, there are also geographic differences when it comes to credit card use. Ninety per cent of people residing in the Greater Toronto Area (GTA) and the Greater Vancouver Area (GVA) reported having at least one credit card when compared to 83% of those residing outside of those cities. This could be due to the fact that apps with mobile payments tend to be available in major cities before other parts of the country (ex. Ritual, Foodora, Just Eat), requiring a credit card to sign up.

While it was no surprise that millennials were more comfortable with credit cards than their boomer counterparts, it was notable that boomers were more likely than millennials to have a low interest credit card and how geography impacts credit card use. Moving forward, it’ll be interesting to see if these trends hold true as millennials get older.

On June 28, the series concludes with Expensive Cities, Part 3: Millennials in Expensive Cities Tend to be More Financially Responsible