Savings Habits of Canadians: Is There a Gender Divide?

In 2016, a Statistics Canada study revealed that Canadian women had lower financial literacy scores than men and were less likely to consider themselves “financially knowledgeable” (31% of women versus 43% of men).

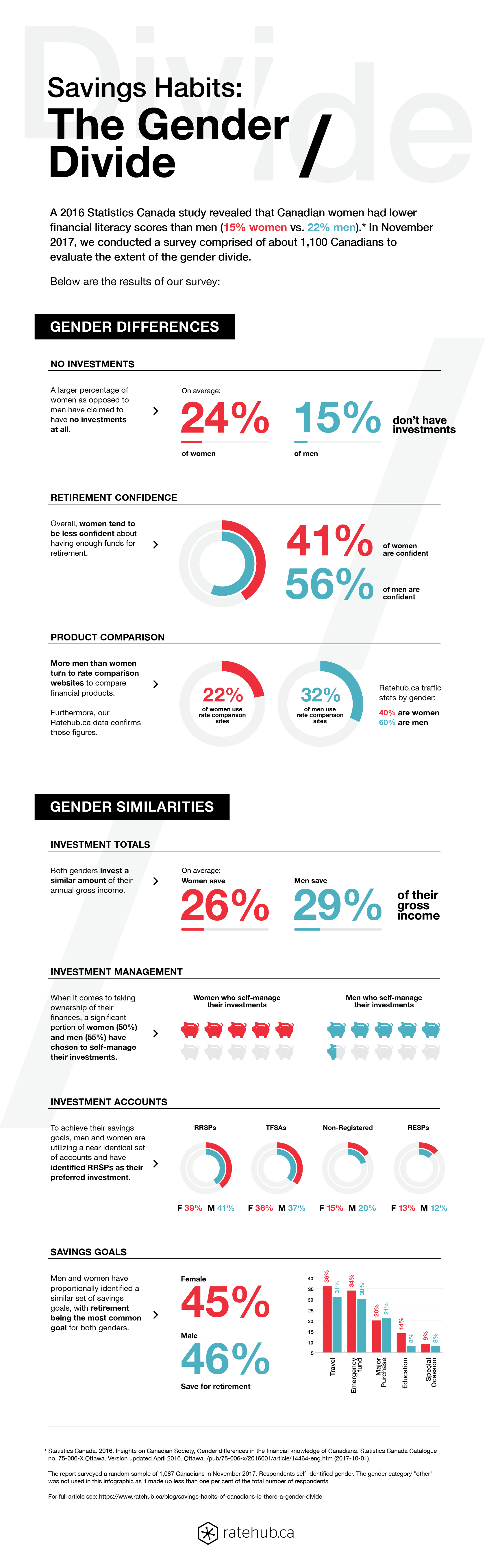

Needless to say, our interest was piqued, so we decided to complete an assessment of the situation to evaluate the extent of the reported gender divide by conducting a survey. Our assessment included analyzing the results of a recent survey designed to uncover Canadian digital money trends. It turns out that although men and women differ in their financial planning, overall their personal finance goals are very similar. Keep on reading to find out what we discovered.

Survey methodology

We surveyed a random sample of 1,087 Canadians in November 2017. Respondents self-identified gender. For the purposes of this article, we didn’t include the gender category selection “other” as it made up less than 1% of the total number of respondents. Here’s what we found:

Gender differences in Canadians’ savings habits

Twenty-four percent of women claimed they have no investments at all—It turns out there’s a significant percentage of both men and women who claim to have no investments at all. Women, though, lead in this category with 24% of female respondents identifying their lack of investments as opposed to just 15% for men.

Fifty-nine percent of women are not confident about having enough funds for retirement—When asked about their retirement confidence, only 41% of women versus 56% of men claimed to be confident about having enough funds for retirement. This finding is especially alarming considering that a higher percentage of women than men also admitted to having no investments at all.

More men than women use rate comparison websites—When it comes to using technology for their financial decisions, our survey found that 32% of men and only 22% of women turn to rate comparison websites to compare financial products. Furthermore, our Ratehub.ca user data supports the usage gap—60/40 split in favour of males.

Read:15 Ways to Save Money Without Living a Bummer Lifestyle

Gender similarities in Canadians’ savings habits

Women and men invest at least a quarter of their income—On average, both men and women invest a similar amount of their gross income (gross income is defined as your total earnings before taxes and deductions). The exact percentages were 29% for men and 26% for women. To put these numbers into perspective, for an average annual salary of $50,000 saving 25% would represent approximately $12,500 yearly.

More than 50% of men and women self-manage their investments—Additionally, our survey found that a significant portion of women (50%) and men (55%) have chosen to self-manage their investments. However, it’s important to note that although we know that both genders are actively investing, we don’t know the portfolio breakdown for each gender (for example, the percentage invested in high-interest savings accounts, GICs, mutual funds, stocks, etc.).

Don’t put your savings on hold

Let Ratehub.ca help you find the best GIC rates today

Men and women identified RRSPs as their preferred investment account—We found that RRSPs are the preferred investment vehicle for both genders—39% of women and 41% of men. TFSAs came in second with 36% of women and 37% of men claiming to have one. As a side note, don’t forget that the 2017 RRSP contribution deadline is March 1, 2018. (You can read more about RRSP contribution limits on our site. Or if you prefer to get a TFSA, be sure to check out our best TFSA rates.)

Retirement is the most common goal for both men and women—As we previously identified, both men and women invest a similar portion of their income, choose to self-manage their investments, and prefer to invest in RRSPs and TFSAs, so it shouldn’t come as a surprise that they share common savings goals. We found that when it comes to their savings goals, both genders identified saving for retirement as their highest priority (45% women and 46% men), followed by travel (36% women and 31% men), and having an emergency fund (34% women and 30% men).

Bridging the gap

In summary, our survey revealed that while men and women differ in aspects of their financial planning, at the core, their personal finance goals and concerns are nearly identical. At Ratehub.ca, we aim to empower all Canadians with the means to make informed financial decisions, and we’re optimistic that as Canadians continue to become aware of the value financial comparison platforms offer, we’ll see an incremental growth in overall financial literacy scores.

If you enjoyed this infographic, share it with your community.

- You can copy and paste this HTML snippet:

OR

- Save the image and link back to this page: https://www.ratehub.ca/blog/files/2017/11/the-gender-divide-infographic.png

Also read: