Top 3 Credit Cards for People Who Earn More Than $70,000 a Year

“Started from the bottom, now we’re here.” It’s true – that’s a song we sing around the office, on occasion. But in this final post of our series on which credit cards are best for all salary ranges, it’s also valid. So far, we’ve shared what the best credit cards are for students, what your options are if you make less than $60,000/year, or if you’re earning between $60,000 and $70,000/year. Today, we’re going to show you what you’re able to get if you make more than $70,000/year.

Truthfully, once you get to this income range, you could technically apply for any credit card you want. You could apply for one of the student cards, if you’d prefer to pay no annual fee and don’t care about rewards. But you can also access the best credit cards in Canada. If you play your cards right, and pay off the balances each month, we’d recommend the latter – because there are some cards that offer huge reward earning potential. Here are the top 3 on our site.

*Note: To compare the cards, we set a monthly spend of $2,500 on “everything”.

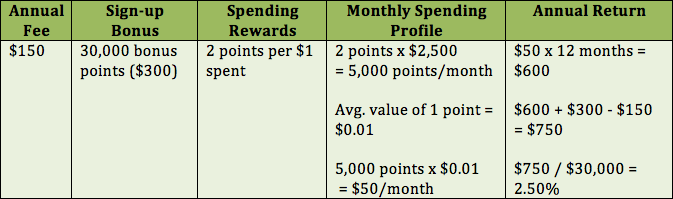

- BMO World Elite MasterCard

If you earn $70,000 or more as an individual, or a household income of $120,000, there’s no doubt that one of the best credit cards in Canada is the BMO World Elite MasterCard. Despite its $150 annual fee, you can earn 2 points for every $1 spent on the card, no matter where you shop. And its sign-up bonus is valued at $300, which technically offsets the annual fee for the first two years. Frequent travellers will love this card, as you can redeem points for travel whenever you want, without having to worry about blackout periods or seat restrictions. It also comes with a long list of travel insurance policies, and gives you special VIP lounge access at certain airports.

If you earn $70,000 or more as an individual, or a household income of $120,000, there’s no doubt that one of the best credit cards in Canada is the BMO World Elite MasterCard. Despite its $150 annual fee, you can earn 2 points for every $1 spent on the card, no matter where you shop. And its sign-up bonus is valued at $300, which technically offsets the annual fee for the first two years. Frequent travellers will love this card, as you can redeem points for travel whenever you want, without having to worry about blackout periods or seat restrictions. It also comes with a long list of travel insurance policies, and gives you special VIP lounge access at certain airports. - MBNA Rewards World Elite

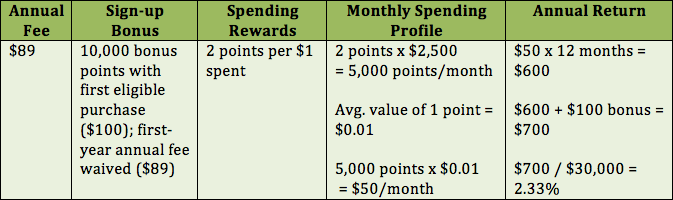

With the same income requirements as the BMO World Elite MasterCard ($70,000 individual or $120,000 household), the MBNA Rewards World Elite credit card offers the second-best return on spending. Despite its $89 annual fee – which is waived for the first year – you’ll also earn 2 points per $1 spent, and get a 10,000-point bonus after you make your first purchase. Under the MBNA Rewards program, you can use points for whatever you want, from travel to cash back to free merchandise – even a charitable donation. And the best part: your points will never expire. This card also comes with extended warranty coverage and its purchase protection insurance means you can be reimbursed for any items repair or replacement.

With the same income requirements as the BMO World Elite MasterCard ($70,000 individual or $120,000 household), the MBNA Rewards World Elite credit card offers the second-best return on spending. Despite its $89 annual fee – which is waived for the first year – you’ll also earn 2 points per $1 spent, and get a 10,000-point bonus after you make your first purchase. Under the MBNA Rewards program, you can use points for whatever you want, from travel to cash back to free merchandise – even a charitable donation. And the best part: your points will never expire. This card also comes with extended warranty coverage and its purchase protection insurance means you can be reimbursed for any items repair or replacement. - Capital One Aspire Travel World Elite MasterCard

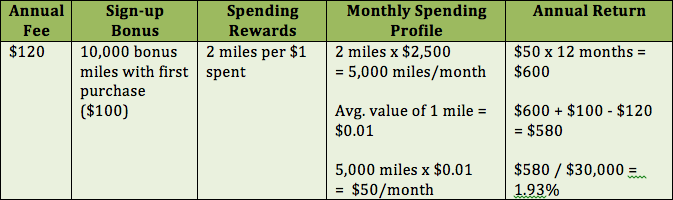

And finally, if you like earning rewards without having to worry about the rules and intricacies of redeeming your points, the Capital One Aspire Travel World Elite MasterCard could be for you. You’ll pay $120 a year, but you’ll have access to the No Hassle Rewards program, which lets you book travel with any airline or hotel that you want, then “erase” the expense with your points after purchase. Like the two cards before, you’ll also earn 2 miles per $1 spent on the card, and you’ll earn a 10,000-point bonus with your first purchase. If you’re a frequent traveller, this card comes with a wide range of benefits, such as travel emergency medical, trip cancellation, trip interruption, flight delay, baggage loss, baggage delay and travel accident insurance; to get them, all you have to do is pay for the travel expense with your new Capital One card.

And finally, if you like earning rewards without having to worry about the rules and intricacies of redeeming your points, the Capital One Aspire Travel World Elite MasterCard could be for you. You’ll pay $120 a year, but you’ll have access to the No Hassle Rewards program, which lets you book travel with any airline or hotel that you want, then “erase” the expense with your points after purchase. Like the two cards before, you’ll also earn 2 miles per $1 spent on the card, and you’ll earn a 10,000-point bonus with your first purchase. If you’re a frequent traveller, this card comes with a wide range of benefits, such as travel emergency medical, trip cancellation, trip interruption, flight delay, baggage loss, baggage delay and travel accident insurance; to get them, all you have to do is pay for the travel expense with your new Capital One card.

Flickr: Sam Churchill