Starter Homes in Manitoba

This three-bedroom, two-bathroom home in South Central Brandon offers open concept living space, a large yard and a double garage, all in a little over 1,250 square feet.

The profile of a first-time homebuyer varies from province-to-province, depending on both affordability and the inventory available. While a starter home in B.C.’s Lower Mainland can have young couples scrambling to put together a down payment for a $450,000 home, the prairies paint a much different picture. In Manitoba, buying a starter home is much more affordable than in B.C. – that is so long as you can find a property to buy.

In the province’s capital city, Winnipeg, there aren’t enough homes for sale compared to the number of people who want to buy.

“The market is getting tougher and tougher for first-time buyers, because there’s so much competition,” said Winnipeg realtor Tim Burns. “A house can be listed on the weekend, receive 4-10 offers, and be sold within a week.”

Because the competition is so tough, not only are houses selling quickly but they are selling for anywhere from 10-25% over and above the asking price.

“People normally understand that but what I have a lot of problems with is that sellers are looking for buyers with no financing conditions,” Burns added. “One of my clients was the highest bidder by $10,000, but he didn’t get [the home] because he had a 48-hour financing condition.”

So what type of homes are first-time buyers competing for? Young couples in Winnipeg can usually get themselves into a 2-3 bedroom home with 700-1,000 square feet of living space and a single garage for $240,000-300,000.

“It’s rare to find a home under $250,000.”

In River Heights, which Burns says is the hottest part of the city, there is currently a 2-bedroom condo listed at $169,900 – but don’t expect it to sell for that low.

“A home in River Heights was recently listed at $269,900 and, after receiving 15 offers, sold for $335,000.”

In Brandon, Manitoba’s second biggest city, the situation is a little brighter. While there is still no excess of inventory, there is no shortage compared to what Winnipeg is seeing.

“If a starter home is priced right, we will run into competing offers, and sometimes it will go for more than [the] asking [price],” said Zach Munn, a realtor in Brandon.

With that being said, prices are generally much lower than what is found in Winnipeg.

“You can purchase starter homes in Brandon for as low as $120,000,” said Munn. “For that price, the house would typically be built in the early 1900s, have two bedrooms and may need some work.”

For young couples or families, 3-bedroom bungalows are typically in the $200-250,000 range. And one area that has been growing more rapidly in Brandon is the condo market.

“Our bungalow condos usually pre-sell and you have to wait for your unit to be constructed,” explained Munn. [To buy into] a four-plex, you are looking [to spend] about $205,900. A 3-bedroom unit would be $225,900.”

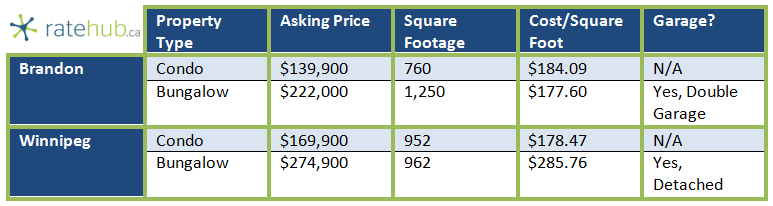

To give you a better idea of starter home prices in Manitoba’s two largest cities, we pieced together this chart using real homes listed on MLS. Note that both of the homes used as Winnipeg’s examples are in River Heights.

Now, the bonus for both cities is that buyers are usually able to buy within the city, rather than having to move outside of it. As Munn points out, buyers who do move to small towns around Brandon end up moving back because of the pains of commuting.

“[Buyers] don’t factor things such as Manitoba roads in the winter and how often they may need to drive them to get to appointments, sporting events, nights out, etc.”

No matter what city a buyer is looking to buy in, now could be the best time to look, while Manitoba mortgage brokers are still offering historically low rates. But as Burns’ examples show, first-time buyers in Manitoba need to stay on top of the market and be ready to put in offers fast.