How to claim GIC income on your taxes

Alyssa Furtado

They say there are only two guarantees in life: death and taxes. It’s dark humour, for sure, but sadly tax time isn’t all fun with big returns.

Depending on which types of investments you hold, you may have to report the interest you’ve earned at tax time — and that’s true of many guaranteed investment certificate (GIC) products. GICs have re-emerged as a favoured choice, thanks to their uniquely low risk, availability, and guaranteed returns. In fact, amid the current economic climate and falling interest rates, GICs are an appealing choice for investors who want to lock in a steady rate of return.

The good news is that if you hold a GIC in a registered account, such as a Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP), you will not have to pay taxes on the interest income it generates. However, it is important to note that with an RRSP, taxes are merely deferred until you withdraw the money from the RRSP structure at a later date.

On the other hand, if your GIC is held in a non-registered account, like a cash account for investing, things work a little differently. In this case, the interest earned from the GIC is fully taxable.

How GIC returns are taxed for non-registered accounts

So, let’s say you’ve earned some interest from a GIC in a non-registered account. How do you report it to the CRA? Here’s what you need to know:

The first thing to keep in mind is that the interest earned from a GIC is taxed as interest income by the CRA.

This means that the amount is taxable at your marginal tax rate, depending on your level of income. Unlike capital gains, 100% of any GIC interest income earned is fully (i.e. 100%) taxable, so there’s no tax advantages to holding GICs in non-registered accounts.

Second, interest is deemed earned in a given year where it is paid and/or accrued. In other words, even if you are paid all the interest only at the end of the term, you’ll still have to pay tax on the money the GIC has accumulated each year you own it.

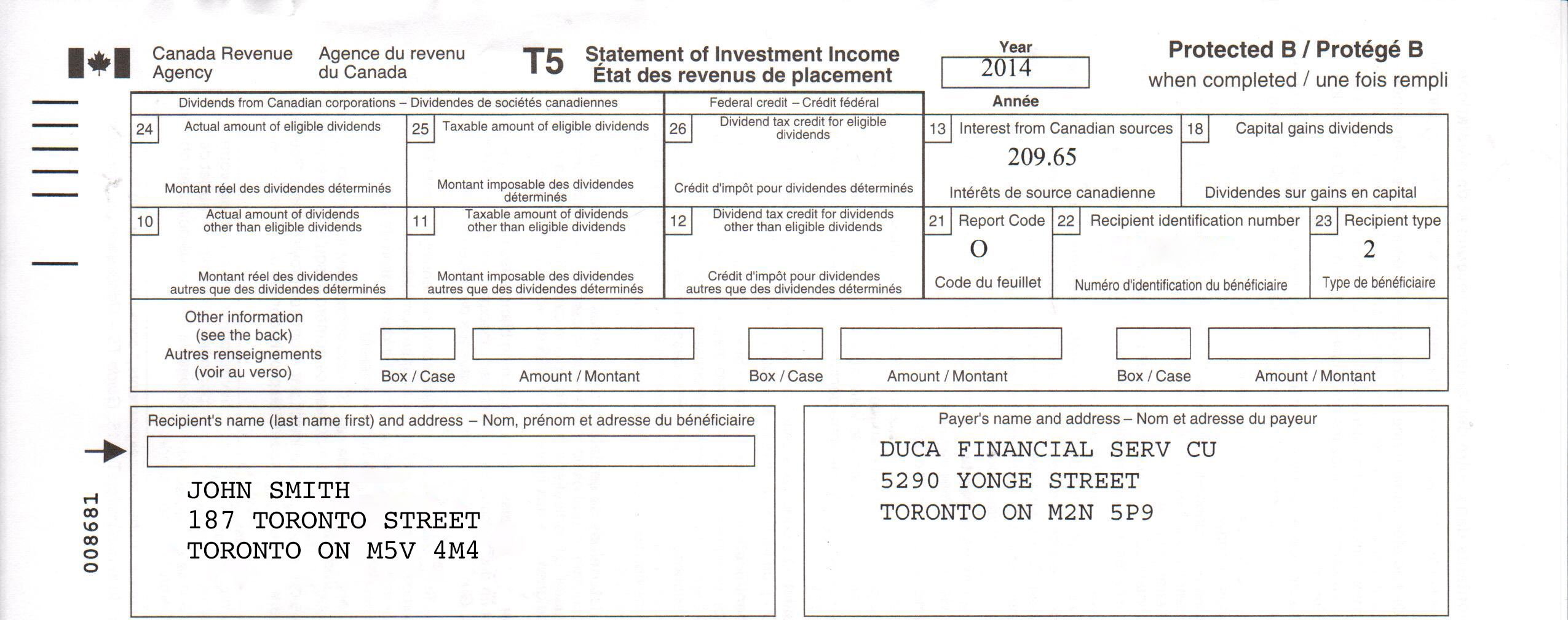

Third, GIC income is reported on what’s known as a T5 Slip. This will be provided to you by the issuer of the GIC (e.g. a financial institution). They will send you this slip well before your taxes are due — so don’t file your taxes before you get it! Below is a sample copy of a T5 with GIC income reported. You will need to claim what’s in Box 13 (“Interest from Canadian sources”) in your personal income taxes.

A fourth thing to be aware of is the tax treatment for market-linked GICs held in non-registered accounts. Because these products pay interest when the underlying investment (such as the stock market) goes up, it may seem intuitive that the interest should be reported as capital gains income. In fact, the return is reported as interest income. Any minimum interest is reported annually to the CRA, and then if there’s a gain upon maturity due to the market rising, that is reported on your taxes for the final year of the GIC.

Getting a bit more complicated, a fifth consideration is how to report income from a foreign currency GIC. Let’s say you have a U.S. dollar GIC that pays you interest in American dollars. This interest must be reported to the CRA in Canadian dollars. As CIBC’s tax expert Jamie Golumbek explained:

The conversion to Canadian dollars can be done either by converting the amount received using the exchange rate that was in effect on the day you received the income or, if the income was received throughout the year, by using the average annual exchange rate for the year. This gives you some flexibility in choosing the most advantageous rate.

Upon the foreign currency GIC’s maturity, you may also have to report a foreign currency gain if you convert the funds back to Canadian dollars, so this is something else to be aware of before you buy a GIC.