Buying GICs in Your RRSP

Guaranteed investment certificates (GICs) can be purchased in both registered and non-registered accounts. Non-registered accounts are simply regular investment accounts that you may have, which do not come with any special tax treatment. Registered accounts, on the other hand, are government-approved structures that allow you to shelter income from taxes.

In this post, we’ll take a look at registered retirement savings plans (RRSPs) – one of the registered accounts in Canada – and why you may want to consider buying a GIC in your RRSPs.

RRSPs Explained

RRSPs are intended to help Canadians with their retirement saving and planning. The federal government currently allows you to contribute 18% of your earned income or $24,930 (the 2015 limit), whichever figure is lower. You can make these contributions every year until you turn 71, and any unused “room” in your RRSP is carried forward to subsequent years. What this means is that if you don’t max out your contribution in one year, you haven’t missed your chance – you can catch up and make those contributions later.

RRSP accounts are widely available at financial institutions across Canada. You can hold many types of investments in these accounts, such as equities, mutual funds and, of course, GICs.

Why Buy GICs in Your RRSP?

There are four key reasons to buy GICs for your RRSP:

- You won’t pay taxes while it’s in the account. RRSPs are a form of tax deferral, meaning that while the money is in the structure, it’s allowed to grow tax-free. It’s only when you withdraw the money from the RRSP that taxes are payable. Because you can accumulate money tax-free until retirement, you have the ability to build up a substantial nest egg.

- Your tax burden is lowered. On top of reason #1, when you contribute to an RRSP, that amount can actually be deducted from your taxable income. Depending on how much you contribute, it may even drop you down into a lower marginal tax bracket.

- You know your return before you invest*. Some RRSP investments, such as equities and mutual funds, go up and down, and a result, you don’t know what your return will be until you own the investment. With most GICs, however, you know how much interest will be paid before you buy it, so you know what it’ll be worth when it matures.

- It protects your principal. Unlike many other investments, what you put into a GIC is guaranteed to be returned to you, both by the bank, and most cases, by CDIC. (You can read more how deposit insurance works here.)

*With the exception of products such as equity-linked GICs.

How Much Can You Save?

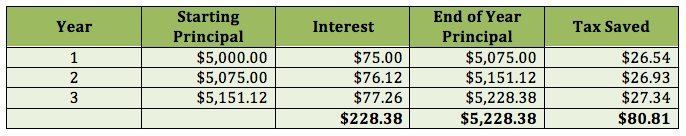

Let’s say you’ve saved up $5,000 for your RRSP and you want to put it into a GIC. You’re looking at a 3-year GIC term that pays 1.50% Oh, and you live in Ontario and pay tax at the 35.39% marginal rate (provincial + federal). How much would you save by investing the $5,000 in an RRSP GIC vs. a GIC in a non-registered account where you would have to pay tax on the interest income?

How much would you save by investing the $5,000 in an RRSP GIC vs. a GIC in a non-registered account where you would have to pay tax on the interest income?

You would earn $228.38 in interest (compounded) over the 3-year term of the GIC, and you would save $80.81 in taxes by placing the GIC in the RRSP structure. You will also get a tax deduction for this amount, which will reduce how much tax you have to pay the CRA.

RRSPs are structures all Canadians should seriously consider. They allow you to save for retirement and build up your portfolio without paying taxes on any gains or income. Among other investments, GICs are definitely one you should keep in mind.

Flickr: Joel Penner

Flickr: Joel Penner