Optional Features to Consider Before Signing Your Mortgage Contract

Flickr: nerdcoregirl

When it comes time to shop around for a mortgage, we know it’s about more than just finding the best mortgage rate. Every mortgage is a little different, depending on what’s written into the terms and conditions of your agreement, and there really is no one size fits all.

At first glance, it may be hard to digest everything that’s included in the fine print of your mortgage contract. However, this is something you’re agreeing to for any number of years, so it’s extremely important to do your due diligence and find out exactly what you’re signing up for.

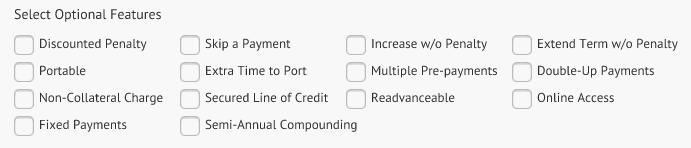

If this is your first mortgage, especially, there are likely also some features you may not even know about yet. Before you sign on the dotted line, here are some optional features you should consider having included in (or excluded from) your mortgage.

Collateral / Non-Collateral Charge

If you think there’s a chance you’ll refinance your mortgage sometime during your mortgage term, you’ll want to get a non-collateral mortgage. Some lenders try to pass off their opposite – the collateral mortgage – as a good financial tool, because it’s a readvanceable mortgage product that allows your lender to lend you more money as your property value increases, without having to refinance your mortgage. However, the downside to that is a collateral mortgage cannot be transferred to another lender – not even at the end of your term. If you want to get out of it, you’ll have to pay a real estate lawyer to help you. Note that most banks offer both options, but TD Bank and Tangerine only offer collateral mortgages; there is no way to opt-in or opt-out – you’re just in.

Discounted Mortgage Penalty

You may or may not know by now that if you break your mortgage contract before your term is up, you’ll be subject to a mortgage penalty. If you have a variable rate mortgage, it’s just three months’ interest. If you have a fixed rate mortgage, however, it’s the greater of three months’ interest or the interest rate differential (IRD) – and the IRD can become expensive fast. If there’s any chance you’ll break your mortgage contract before your term is up for renewal, you should try to find a lender who uses a discounted mortgage penalty. Only 13 or so lenders offer it in Canada – mostly credit unions and wholesale lenders – but rather than using the posted rate penalty calculation most of the big banks use, the discounted penalty option gives you what approximates as a “fair” penalty – just enough to compensate the lender for you breaking your contract early.

Extended Ports

If you have a portable mortgage – one that can be transferred from your current home to a new home you buy – and you plan to take advantage of that option one day, you should also consider getting a mortgage that offers an extended number of days to port your mortgage. Typically, you only get 30 days to port your mortgage. If that’s what was in your agreement and your port happened to take 31 days, you’d be subject to the mortgage penalty outlined in the feature above (and probably not the discounted type, unless you find a mortgage with both options). Fortunately, extended ports can go up to 60, 90 and even 120 days. By finding a mortgage product that offers this feature, you can confirm your lender is willing to offer some flexibility when porting its mortgages.

Semi-Annual Compounding

Most fixed rate mortgage products compound the interest on a semi-annual basis, however, some variable rate mortgage products do it monthly. The more frequently your interest is compounded, the more interest you’ll end up paying. Fortunately, you can pick and choose until you find a mortgage with semi-annual compounding – you just needed to know you could (and should) ask for it!

Double-Up Payments

This feature is exactly what it sounds like. Let’s say your mortgage payment was $1,000/month. If your mortgage came with a double-up payments feature, you could pay $2,000/month instead, without penalty. It’s essentially just another lump sum prepayment option, but it’s a specific amount (double your regular payment amount) versus the regular lump sum prepayment option, which is quoted as a much smaller percentage of your existing payment amount (e.g. up to 15%). Very few lenders offer this feature, but if you think you’re going to have extra money coming in, it’s a great way to pay down your mortgage sooner and without penalty.

Online Access

Finally, this one may seem obvious, but you’ll probably want to get a mortgage you have online access to – a place where you can login and see your balance, amortization schedule, make prepayments, etc. The big banks all offer this, of course, but some of the smaller lenders and wholesale lenders don’t. If having this type of access is important to you and how you conduct your daily finances, confirm it’s an option with your lender.

intelliMortgage recently updated its Mortgage Builder tool to include these features and more, all of which are meant to add flexibility to your mortgage financing. You may not need them all, but you also can’t predict how life could change in the next 3, 5 or 10 years. Mortgage broker Rob McLister’s advice: If you can check some of these boxes and not have the mortgage rate change, take advantage of that and get all the right features for you.

Were there any features in your mortgage you didn’t know about or understand until after you’d signed?