Mortgage Monday Update: September 26, 2011

“Policy rates are going to take a long time to rise – until after at least 2013, not only in the US but also in Canada” – Michael Gregory, senior economist at BMO Capital Markets.

5 YEAR FIXED RATES

On Friday, the five-year Government of Canada bond yield finished 20 basis points from last week’s 1.55%. The drop can be attributed to the continuing economic downturn we are seeing globally. This is especially true with the United States who, according to the Bank of Canada Governor Mark Carney, are experiencing the weakest recovery since the Great Depression. Although our five-year yields are hovering at record lows, we’re still at a much higher yield than other major countries such as the UK and Germany. Canadian Mortgage Trends paints the picture that it is possible for the five-year bond yield to hit 1.00%, which in turn could cause five year fixed rate mortgages to plummet, since there will always be investors willing to settle for super-low yields from less stable economic countries.

On the other hand, if Greece continues to flirt with default (or any other Eurozone nation) it could increase risk premiums leading to higher fixed mortgage rates.

Last week, we witnessed CIBC and TD drop their discounted 5-year fixed rates.

VARIABLE RATES

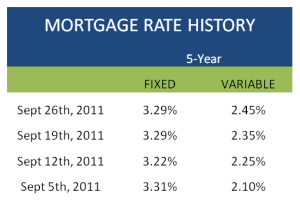

Variable interest rates are trending upwards and it was no different last week as the best discounted 5-year variable rate on Ratehub.ca went up 10 basis points (as seen in the chart below). Last week, only RBC dropped their 5-year variable rate to 2.75%, but still trails ING Direct as the best variable bank mortgage rate.

MORTGAGE QUALIFYING RATE

The Bank of Canada Qualifying rate has decreased from 5.39% to 5.19% which becomes effective today.

CURRENT MORTGAGE RATES

Discounted weekly 5-year fixed mortgage rates and 5-year variable mortgage rates from January 2011 to the present.

A five year history of discounted weekly 5-year fixed mortgage rates and 5-year variable mortgage rates.

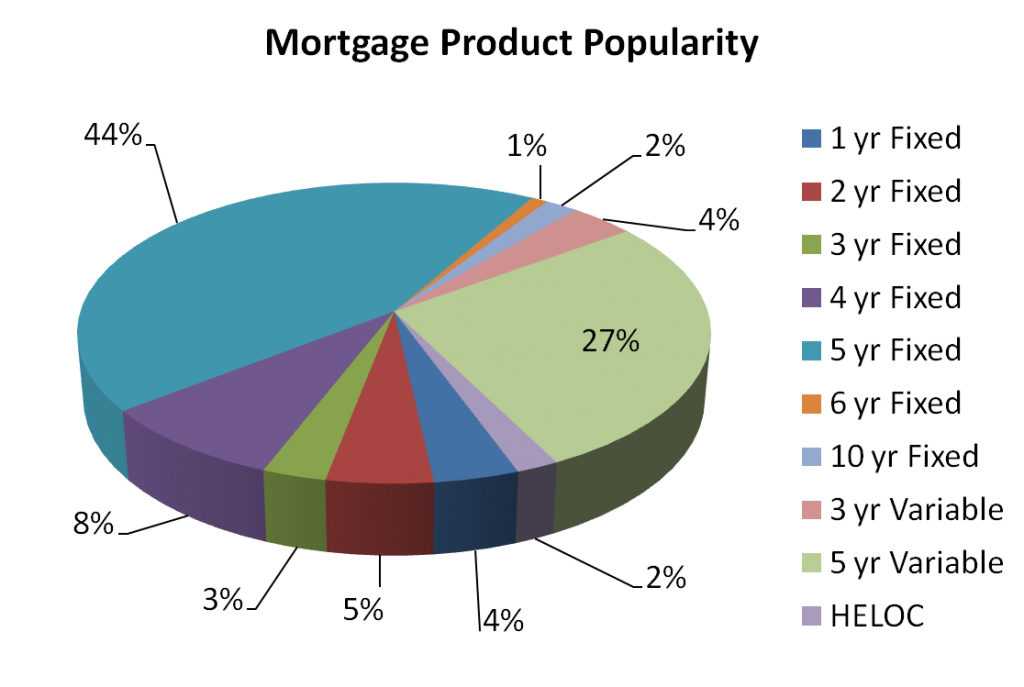

What mortgage products are Canadians buying?

The spread between 5-year fixed mortgage rates and 5-year variable rates continues to shrink from week to week. 5-year fixed mortgages have taken over 5-year variable mortgages after many weeks of the latter enjoying product preference on Ratehub.ca.

Sources