Monday Mortgage Update: October 3, 2011

MORTGAGE MOVEMENT

There wasn’t much movement from 5-year Government of Canada bond yields last week, finishing only marginally higher at four basis points. Most lenders stood pat with their 5-year fixed rates.

There was also very little action from variable mortgage rates last week as well. A few lenders raised some of their 5-year variable rates, such as ING Direct, but otherwise, it has been a quiet week for mortgage rates.

The Canadian Real Estate Association (CREA) expects the key overnight rate to remain at 1.0%, which means variable rates shouldn’t see much movement from now until 2012. Next year is where CREA expects the key overnight rate to rise to 2.0%.

HELOCs

As revealed by David LaRock of Move Smartly, the OFSI (The Office of the Superintendent of Financial Institutions) will be paying more attention to Home-Equity-Lines-of-Credit. Basically, a tightening of the underwriting rules could be possible in the foreseeable future.

CURRENT MORTGAGE RATES

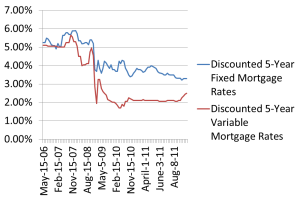

Discounted weekly 5-year fixed mortgage rates and 5-year variable mortgage rates over the past five years.

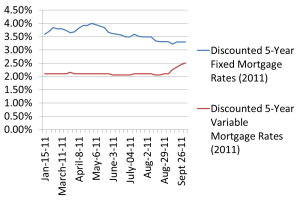

Discounted weekly 5-year fixed mortgage rates and 5-year variable mortgage rates from January 2011 to the present.

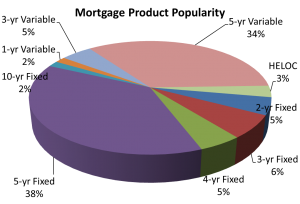

What mortgage products are Canadians buying?

Five-year variable interest rates are climbing every week, where the lowest available rate sits at 2.50%, up 5 basis points from last week. 5-year variable rates have been steadily climbing since the end of August, where they were at 2.05% during that time. Speaking of HELOC mortgages, Ratehub.ca saw a small bump in Home Equity loans last week.

Note: This is simply a small sample size and does not represent the entire market. It does, however, offer some useful insight.