Monday Mortgage Update: November 21, 2011

The annual inflation rate dropped back down below the three percent mark to 2.90% in October, which in all likelihood diminishes most rate cut expectations going forward. It’s important to note that the inflation rate is still higher than expected. A recent RBC poll revealed that one third of Canadians over the age of 55 have 16+ years left on their mortgage. This means that means they expect to be mortgage-free not until their 70s. As a comparison, the average life expectancy in Canada is approx. 81 years, according to StatsCan. That leaves only 10 years for older Canadians to be able to live mortgage-free!

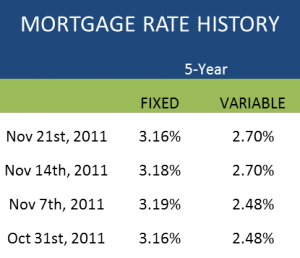

Canadian Mortgage Rates

There wasn’t much activity with any of the Government of Canada bond yields last week. As both short term and long term yields saw none to very little movement last week. Hence, fixed mortgage rates last week barely moved, although this has to do with lenders unwilling to move the needle more than anything.

Variable rates did not move, but the spread between fixed rates shrunk for the second week in a row.

Although the possibility of rate cuts in the near future may have been weakened, we should continue to see low mortgage rates in the future.

Current Mortgage Rates

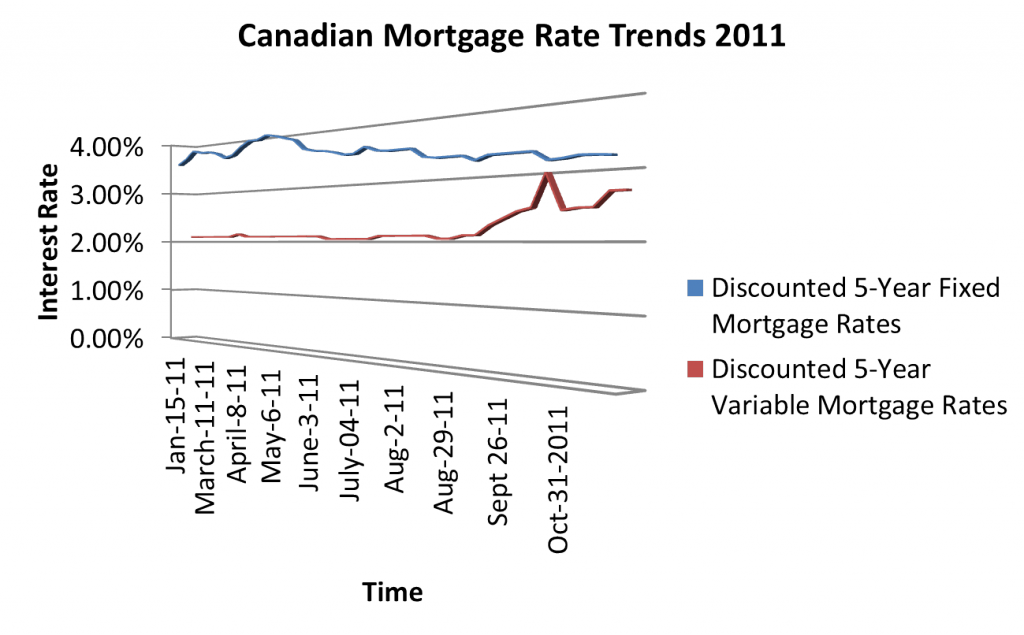

Discounted weekly 5-year fixed mortgage rates and 5-year variable mortgage rates from January 2011 to the present.

Discounted weekly 5-year fixed mortgage rates and 5-year variable mortgage rates over the past five years.

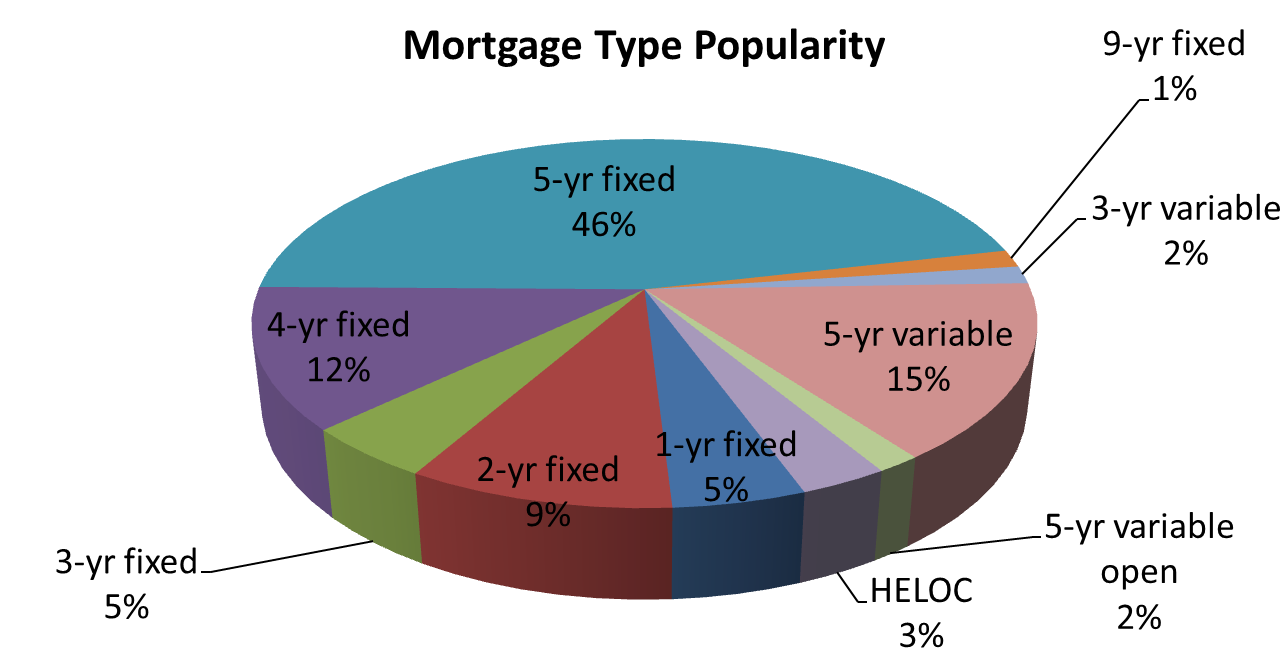

What mortgage products are Canadians buying?

Last week, 5-year variable rate mortgages saw a major dip in terms of market product share. Typically, we find the 5-year variable on par with 5-year fixed mortgages. The more the spread reduces, the greater it favours fixed rates. Something of a surprise was the appearance of a 9-year fixed rate mortgage. Generally, longer-term fixed mortgages aren’t as popular as the short and mid term mortgages.

Note: This is simply a small sample size and does not represent the entire market. It does, however, offer some useful insight.