Monday Mortgage Update: July 23, 2012

Interest Rates Remain Steady

Last week, the Bank of Canada (BoC) made its fifth scheduled key interest rate announcement of 2012, and as expected, this rate remained at 1.00%, where it has been for almost two years.

At the same time, the BoC released its latest Monetary Policy Report (MPR), which is designed to give Canadians a look at where both the global and Canadian economy may be headed down the line.

This report is far more cautious in nature than the last MPR, which was released in April, and the BoC is forecasting weaker prospects for global economic growth, and is expecting the Canadian economy to pick up the pace in terms of growth in 2013. Currently, the BoC is projecting a 2.1 per cent growth in 2012 (down from April’s forecast of 2.4 percent in 2012 and 2013), 2.3 per cent in 2013, and 2.5 per cent in 2014 (up from 2.2 per cent).

“The economy is expected to reach full capacity in the second half of 2013, thus operating with a small amount of slack for somewhat longer than previously anticipated.” – BoC Monetary Policy Report, July 2012

Unlike April’s report, this one does not come with a warning from the BoC in regards to mortgage rates rising faster than expected.

Bond Yields Down

Five-year Government of Canada (GoC) bonds decreased three points last week, closing at 1.15 per cent on Friday. As five-year GoC bond yields drive fixed mortgage rates, we could be seeing a slight decrease in fixed rates over the next few weeks.

Mortgage Rate Recap

Earlier this month, a number of banks – including both TD and RBC, dropped their 1-year and 2-year fixed rates. Last week, Bank of Montreal and National Bank followed suit, reducing their 1-year and 2-year fixed rates to remain competitive. Desjardins also decreased their 2-year fixed rate, while TD Canada Trust reduced their 3-year fixed rate by 10bps from 3.95% to 3.85%.

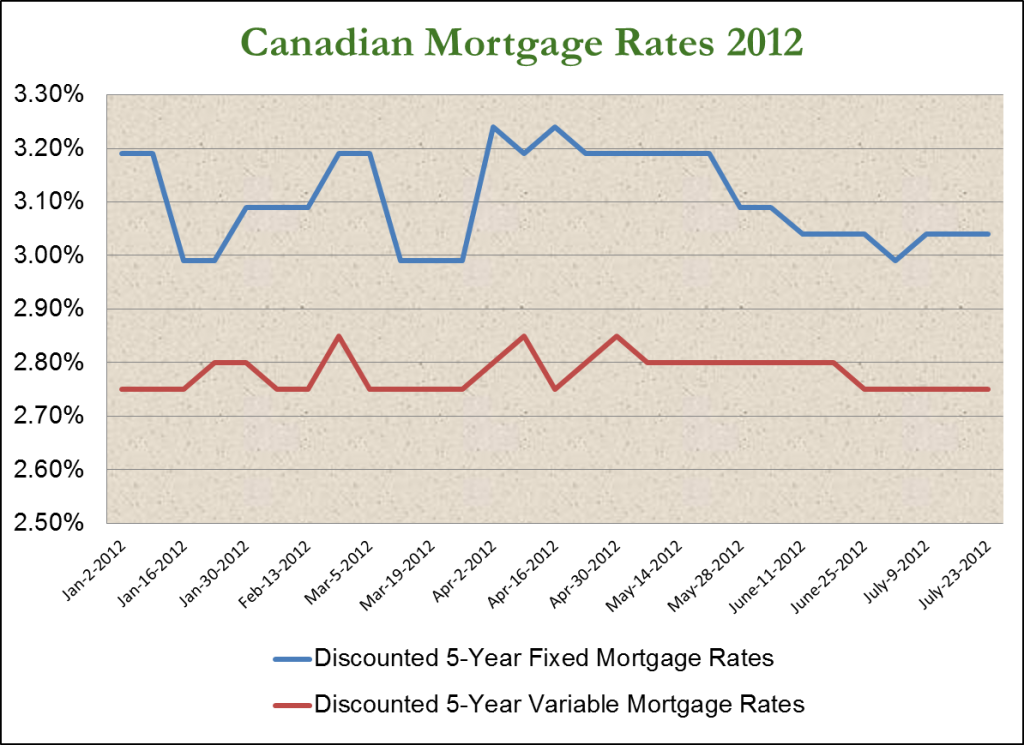

Where are Canada’s Mortgage Rates this week?

A history of weekly 5-year fixed mortgage rates and 5-year variable mortgage rates

Canadian Mortgage Rates in 2012

Note: This is simply a small sample size and does not represent the entire market. It does, however, offer some useful insight.