Millennials: Time Needed to Save for a Down Payment in Canada’s 100 Biggest Cities

Millennials: Time Needed to Save for a Down Payment in Canada’s 100 Biggest Cities

With a national average home price a little under $500,000, Canada’s housing market is considered one of the most expensive in the world. And with this price tag, the corresponding down payment may be simply discouraging, especially for Millennials; this demographic, earning an average of $79,660 per couple, should shell out, on average, $25,000 for the down payment of their future home.

However, according to a nationwide survey of over 9,000 prospective homebuyers, Point2 Homes discovered that 10% of survey takers under 38 years old have no savings at all and 30% had saved less than $10,000 at the time of the survey. Despite their meager savings, 66% of the Millennials who want to buy a home would like to do so within one year.

So how close are they to reaching their homeownership goals? Point2 Homes analyzed the average home prices and average incomes in Canada’s 100 biggest cities to see how much time Millennials would need to save enough for a down payment.

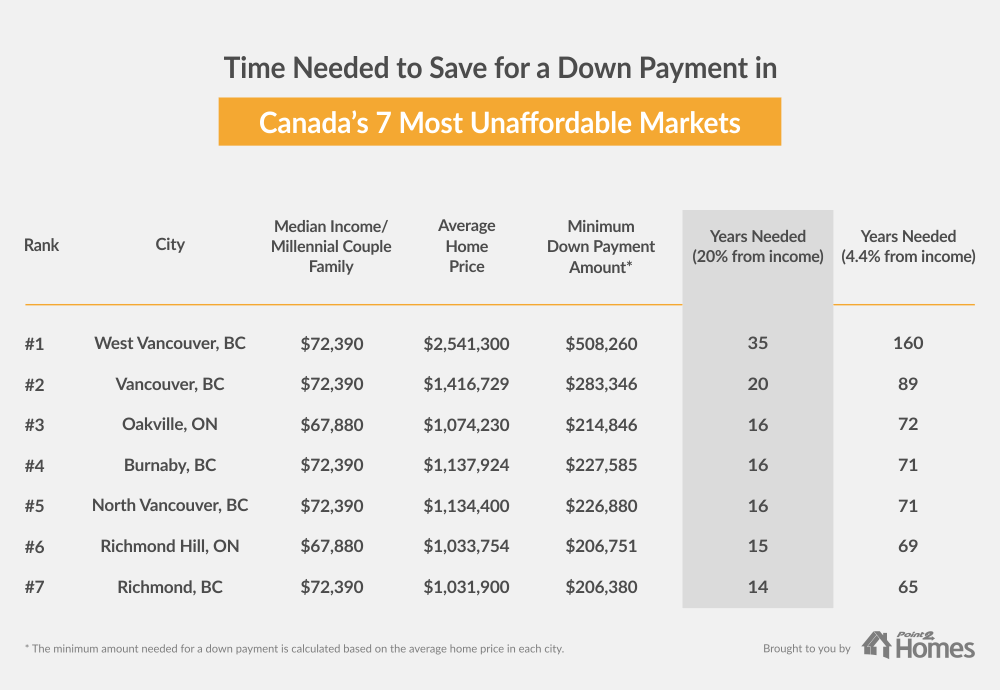

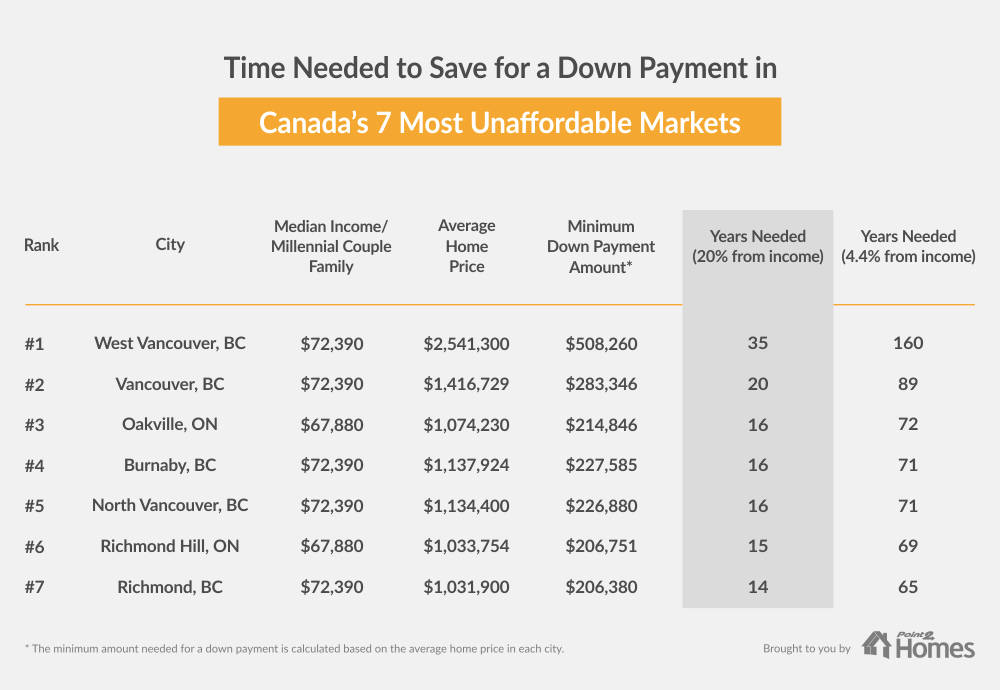

Provided they set aside 20% of their income each month, in the nation’s most expensive markets Millennials would need between 14 and 35 years, but many other markets are much more affordable, with significantly shorter time frames.

7 Canadian Markets Too Hot for Millennials

Saving enough money for a down payment is the first hurdle on the road to homeownership, but seven markets might be totally unattainable for Millennials. In West Vancouver, Gen Y-ers will need 35 years to save for a down payment, and only if they set aside 20% of their income every month, without exception. Vancouver comes next, with a time frame of 20 years under the same conditions, and Oakville, ON is third, with 16 years.

If that weren’t bad enough, the actual household saving rate in Canada in the second quarter of 2018 was not even close to 20%, but actually 4.4%. Under these conditions, Millennial couples would need a shocking 160 years to save for a down payment in West Vancouver, 89 years in Vancouver, and 72 in Oakville.

Homes for Every Budget in Canada’s 10 Biggest Cities

Probably to the surprise of no one, Vancouver is the most challenging for Millennials. Even if they saved 20% of their income month after month, Gen Y-ers looking to settle down in Vancity would need around 20 years to save enough for a down payment. And with Canadians’ actual saving habits, they would need almost 90 years.

Toronto’s real estate market comes in at number two, but the saving time frame is already four times lower: in Ontario’s capital, Millennial couples could cover their down payment in approx. five years. Mississauga Millennials would only need around four years.

Young homebuyers looking for homes for sale in Calgary, Ottawa, Edmonton, or Winnipeg, are the most fortunate: in these urban centres, which are much more affordable, Millennials would only need around one year to meet their down payment requirements.

In 40 Cities, Millennials Need 12 Months or Less to Save for a Down Payment

Timmins, ON is the most Millennial-friendly city in Canada when it comes to homeownership: a young couple would only need about five months to cover their down payment here. Trois-Rivières, QC comes second, with a saving time frame of six months, at a tie with Cape Breton, NS.

There is a total of 13 cities in Québec, nine in Ontario, and seven in Alberta where Millennials could become home owners in under 12 months.

The first hurdle on the path to homeownership is the down payment. Millennials, a demographic that is naturally earning less than the more professionally experienced Baby Boomers or Gen X-ers, is more affected by the shortage of affordable homes in Canada’s major urban centres. However, homeownership remains an achievable life goal in Canada, despite the roadblocks that make many young people struggle more.