How the Marriott Bonvoy Program Works

When Marriott International Inc. acquired Starwood Hotels and Resorts Worldwide Inc. back in 2016 to become the world’s largest hotel company, it was clear the launch of a new hotel loyalty program was imminent.

That’s because the purchase – which came in at a cool $13 billion USD – not only brought together 30 hotel brands under the single ownership of Marriott, but three loyalty programs as well: Marriott Rewards, Ritz Carlton Rewards, and the popular Starwood Preferred Guest program (more commonly known by its abbreviation SPG).

While there was a transitional period where you could still earn SPG Starpoints and Marriott Rewards points, in February 2019 Marriott did the expected; it combined and rebranded all its programs into one – Marriott Bonvoy. If you’re a frequent traveller, this new streamlined program brings more simplicity, as you can now use a single points program to book your hotel stays almost everywhere.

Below, we break down how the Marriott Bonvoy program works.

About the Marriott Bonvoy program

Marriott Bonvoy – born out of the merger of SPG, Marriott Rewards and Ritz Carlton Rewards – is the world’s largest hotel loyalty program.

Members of the Marriott Bonvoy program can earn and redeem Bonvoy points at over two-dozen hotel brands and 7,000 properties across 130 countries, including:

- All Marriott International properties (Marriott Hotels and Resorts, Ritz Carlton, Courtyard, Delta Hotels, Fairfield Inn, SpringHill Suites, AC Hotels, Gaylord Hotels, Residence Inn, Towneplace Suites); and

- All Starwood Hotels and Resorts Worldwide properties (Starwood Hotels, St.Regis, Westin, Sheraton, Four Points, W Hotels, Le Meridian, Aloft, Element, Tribute Portfolio, Design Hotels).

With the merger comes more flexibility, as Bonvoy lets you redeem your points at more hotels than you ever could’ve as a Member of just SPG or Marriott Rewards alone. You can also take advantage of great Bonvoy Member perks like free wi-fi and keyless entry, and if you achieve Gold status, complimentary room upgrades.

While Marriott Bonvoy is first and foremost a hotel loyalty program, Bonvoy Members can also redeem points for flights, gift cards, merchandise, car rentals, and even transfer points to a number of partner airlines.

How to earn Marriott Bonvoy points

You can become a Bonvoy Member and earn Bonvoy points in one of two ways:

- By applying for the Marriott Bonvoy Credit Card; or

- By registering as a free Marriott Bonvoy Member online.

1. With a credit card

Being a Marriott Bonvoy credit card holder is one of the fastest and most straight-forward ways to rack up Bonvoy points. That’s because, with the Bonvoy Card from American Express, you’ll earn Bonvoy points on all your everyday purchases – not just on your Marriott-hotel related spending. So you’ll rack up points for every dollar you spend on groceries, refilling your gas tank, and eating out, as well as when booking hotel stays.

The Marriott Bonvoy American Express Card, which made our 2019 rankings as one of the best travel credit cards in Canada, also comes with additional perks including late check-outs, one free hotel stay every year, lost baggage and hotel burglary insurance, and a big sign-up bonus that on its own is enough to book upwards of 4 free nights at eligible hotels.

Best for Hotel stays

based on spending $2,200/mo after $120 annual fee

- Earn rewards

2pts – 5pts / dollar spent

- Welcome bonus

95,000 points (a $1,111 value)

- Anniversary bonus

15,000 points (a $176 value)

- Annual fee

$120

Perks of the The Marriott Bonvoy® American Express®* Card

| Perks | Details | |

|---|---|---|

| Lounge access | Not included | You’ll gain complimentary passes to airport lounges. The number of passes and lounges you have access to will vary. |

| Waived foreign transaction fees | Not included | A surcharge that credit card holders pay for purchases made in a foreign currency (typically 2.5%). |

| Travel accident insurance | $500,000 per person | If you suffer a loss as a result of an accidental bodily injury sustained while occupying a common carrier, you are eligible for this coverage. |

| Travel emergency medical | Not included | If you require urgent medical care while on a trip outside of your home province, you will be covered for any eligible medical expenses incurred. |

| Car rental insurance | MSRP of up to $85,000, for 48 days | Credit card rental car insurance usually covers theft, loss and damage to your rental car in the case of an accidental collision. |

| Trip cancellation | Not included | If you have to cancel your trip before it’s even started, your prepaid travel costs will be covered up to a maximum amount if the cause of cancellation is eligible for the insurance. |

| Trip interruption | Not included | If your trip has to be cut short or is delayed after the scheduled departure date, you will be covered up to a maximum amount for an eligible cause of interruption or delay. |

| Flight delay insurance | $500; delays 4 hours or more | If your flight departure is delayed by a certain number of hours, you’ll be reimbursed a certain amount for necessary and reasonable expenses. |

| Baggage loss insurance | $500 per trip for all persons | If your checked bag cannot be located by a common carrier, you’ll be reimbursed for a portion of the replacement cost of lost personal property. |

| Baggage delay insurance | $500; delays 6 hours or more | If your checked bag is not delivered within a specified time upon your arrival, you’ll be reimbursed for the cost to replace essential items. |

| Hotel/motel burglary | Included | Provides protection, while you’re checked in, for your personal belongings when left unattended in your room up to a certain dollar amount. |

| Mobile insurance | Not included | Reimburses a portion of your cell phone in the event it’s damaged or lost. Device coverage is limited to a certain period of time after purchasing with your credit card. |

| Purchase assurance | Up to $1,000 for 90 days | Automatically protects new purchases by insuring them for 90 days from the date of purchase in the event of loss, theft or damage. |

| Extended warranty | Up to one additional year | Either doubles the length of the item’s manufacturer’s warranty coverage or extends it by 1 year, whichever is less. |

| Price protection | Included | If, within a certain amount of time of purchasing an item, its price drops or you find an identical item offered for a lower retail price than what you paid, you will be reimbursed for the difference. |

Other perks

- Experience Amex’s best offer this year on the Marriott Bonvoy® American Express®* Card

- New Marriott Bonvoy® American Express®* Cardmembers earn up to 110,000 Marriott Bonvoy® points

- Earn 65,000 points after you spend $3,000 on your Card in your first 3 months of Cardmembership.1

- Earn an additional 30,000 points after you spend a total of $20,000 on your card in your first 12 months of Cardmembership.1*

- Plus, earn 15,000 points when you make a purchase between 15 and 17 months of Cardmembership.1*

- Offer ends August 18, 2025.

- Earn 5 points for every dollar in eligible Card purchases at hotels participating in Marriott Bonvoy®

- Earn 2 points for every $1 in all other Card purchases

- Receive an Annual Free Night Award for up to 35,000 points at eligible hotels and resorts worldwide every year after your first anniversary

- No annual fee on Additional Cards

- Redeem points for free nights with no blackout dates at over 7,000 of the world’s most desired hotels

- Automatic Marriott Bonvoy Silver Elite status membership

- Receive 15 Elite Night Credits each calendar year with your Marriott Bonvoy® American Express®* Card. These can be used towards attaining the next level of Elite status in the Marriott Bonvoy program

- Enjoy an automatic upgrade to Marriott Bonvoy Gold Elite status when you reach $30,000 in purchases on the Card each year or when you combine 10 qualifying paid nights within one calendar year with the 15 Elite Night Credits from your card

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment

Ratehub’s take

The Marriott Bonvoy American Express Card is tailor-made for hotel rewards, making it an excellent choice for frequent travellers who want to stay in style. It’s one of the best travel credit cards in Canada.

Pros

- Extensive hotel network: Access more than 7,000 hotels worldwide under the Marriott Bonvoy loyalty program

- Annual free night: Enjoy an annual free night’s accommodation at any Marriott Bonvoy hotel

- Silver Elite status: Receive complimentary Marriott Bonvoy Silver Elite status, which can get you exclusive discounted rates and higher points earn rates

- Points earning: Earn five Bonvoy points for every $1 spent on eligible card purchases at hotels participating in the Marriott Bonvoy® program, and two Bonvoy points per dollar on all other card purchases

- Versatile redemption: Redeem points for free nights at more than two dozen hotel brands, including Marriott, Starwood Hotels and Resorts, W Hotels, St. Regis, Ritz Carlton, Sheraton and Delta

Cons

- Travel insurance limitations: The card does not include travel emergency medical insurance within its insurance package

- Points worth less for flights: While you can transfer your Marriott Bonvoy points to other flight reward programs, they are worth less at a ratio of 3 points = $1

Eligibility requirements

Minimum credit score: 725

Minimum income: N/A

Interest rates

Purchase interest: 21.99%

Cash advance: 21.99%

Balance transfer: N/A

While the Marriott Bonvoy Card is the official branded credit card of Marriott Bonvoy, you can also earn Bonvoy points with almost any other American Express rewards card by strategically taking advantage of point transfers.

American Express Membership Rewards points, which you can earn on AMEX rewards cards like the American Express Cobalt, can be transferred to Marriott Bonvoy points at a 5:6 ratio. So, for every 1,000 American Express Member Rewards points you transfer, you’d get 1,200 Bonvoy points. It may not be as straightforward as using the co-branded card, but this transfer is a lucrative option that also lets you earn Bonvoy points on all your everyday purchases.

The card now also features a generous welcome offer, you can earn 1,250 points for each month you spend $750, up to a maximum of 15,000 points.

2. As a Marriott Bonvoy Member without a credit card

As a free Marriott Bonvoy Member, signing up is easy but you’ll only earn points on your Marriott-related spending and on nothing else. Without the Marriott Bonvoy credit card, you’ll earn between 5 to 10 points per $1 USD (roughly $1.33 CAD) you spend on:

- Hotel stays at eligible Marriott Bonvoy hotels;

- Marriott Bonvoy hotel amenities, restaurants, and vacation packages;

- Marriott tours and events; and

- Available limited time offers from retailers partnered with Marriott Bonvoy.

Bonvoy points value and hotel redemptions

According to our calculations, we’ve estimated the average value of 1 Bonvoy point to be $0.0177 – or the equivalent of 1.17%. Since Marriott Bonvoy is first and foremost a hotel loyalty program, our average is based on hotel stay redemptions.

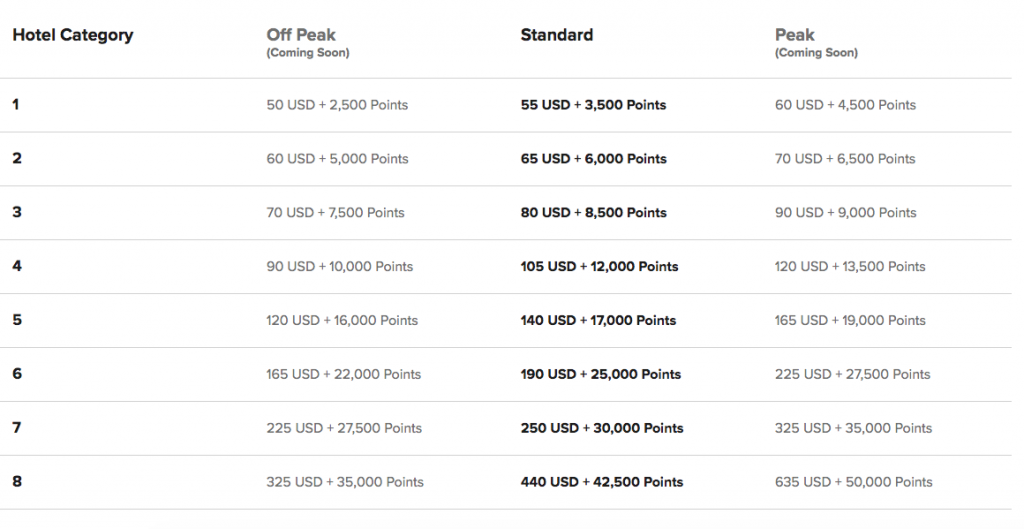

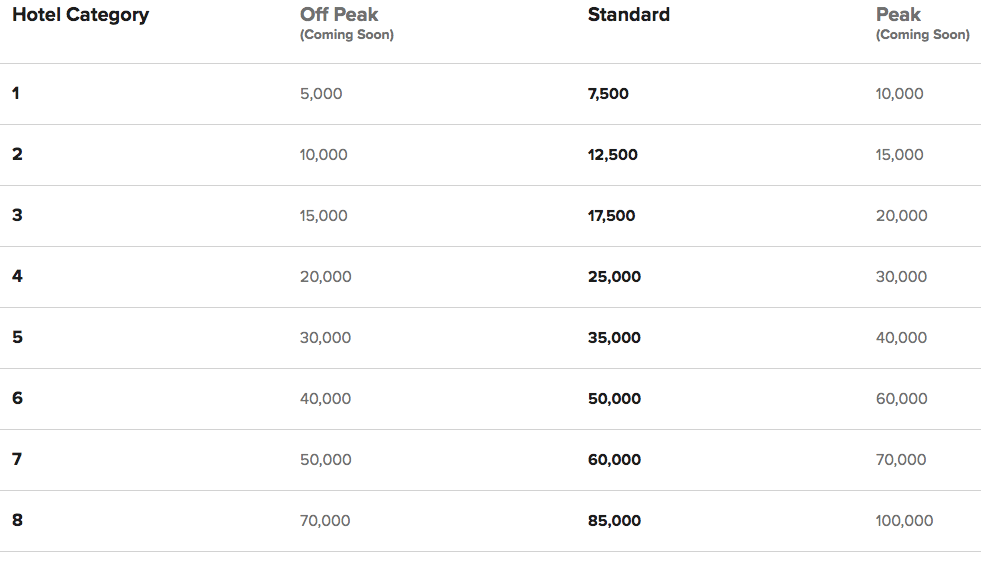

Our calculation is just an average though and point values do vary per hotel stay based on the Bonvoy rewards chart (below), which factors for: the time of the year; the price of the hotel; and the category of the hotel (which Marriott ranks on a scale from 1 to 8, with 8 being the most premium).

Along with the ability to book stays at thousands of hotels worldwide with no blackout dates, one of the biggest advantages of the Marriott Bonvoy program is that you’ll get one night free for every 5 days you book on points. That’s an automatic 20% boost in value. Redemptions can be made when booking hotel stays online or over the phone.

If you want to book a hotel stay on points but don’t have enough to cover the complete cost, Marriott Bonvoy also lets you use a mix of points and cash.

Bonvoy airline transfer options

Bonvoy points can be transferred to over 40 airline loyalty programs, including the likes of Aeroplan, Air China Phoenix Miles, AA Advantage Miles, and more. In most cases, you can transfer points at a rate of 3 Bonvoy points for 1 Mile.

The real advantage here is that Bonvoy will give you a bonus 5,000 miles for every 60,000 Bonvoy points you transfer. If you transfer fewer than 60,000 points, you’ll miss out on the bonus and, in that case, you could be better off sticking to using your Bonvoy points for hotel stays.

Instant redemptions

Aside from booking hotel stays, you can also use your points instantly to cover anything that can be charged to your hotel room – like your room service tab.

While it may be convenient, this option only lets you redeem 250 points for $1USD, so it doesn’t offer much bang for your buck – especially when compared to hotel stay redemptions. It’s therefore almost always better to save your points for full-fledged hotel stays rather than to chip away at your other hotel bills.

Redeem for flights or car rentals

Along with the ability to transfer points to airline loyalty programs, you can also use Bonvoy points directly to book flights through Marriott’s travel search engine. There’s plenty of flexibility here as you can redeem Bonvoy points to book flights on over 200 airlines, use points to cover the cost of taxes and fees, and even opt for a mix of points and cash.

But, the flexibility doesn’t make up for the fact this option offers considerably lower value for your Bonvoy points. In some cases, you’ll get half as much value out of flight redemptions when compared to hotel stay redemptions.

The ability to use points to cover the cost of car rentals is another nice touch, but in the same vein as flight redemptions, they offer far less value for your points.

Redeem for travel packages

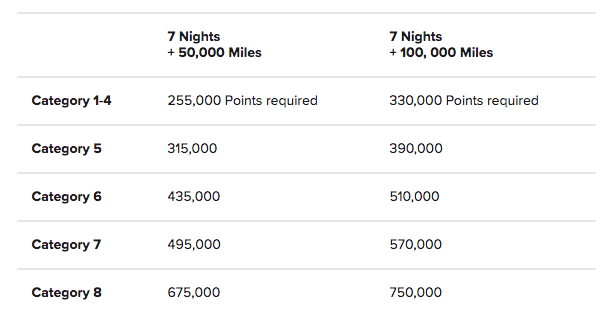

Unlike redeeming for just a flight, taking advantage of Bonvoy’s travel packages (which combine flights and hotel stays together) can be a good deal.

Known as a Hotel + Flight Package, this option lets you do double duty and transfer Bonvoy points to airline miles plus book a hotel stay as part of one sweeping redemption. By using this package, you could save upwards of 15,000 points compared to if you transferred points and booked a hotel stay separately.

There are some caveats though. First, you’ll need a tonne of points to take advantage of this package (we’re talking at least 255,000). Second, Hotel + Flight Packages can only be booked over the phone and not online. Lastly, these packages are specifically for 7-day trips and for Bonvoy Members who plan on both transferring points into airline miles as well as redeeming for hotel stays. If you were thinking of using points just to book a hotel stay, this package won’t be the right fit for you.

Gift cards and merchandise

Most rewards programs don’t offer the best value when redeeming for gift cards, and the Marriott Bonvoy program is no different. To maximize the value of your points, avoid gift cards or merchandise and stick to what the Bonvoy program was made for: hotel stays or airline point transfers. You can view Bonvoy’s shopping catalogue here.

Also read: