intelliMortgage Launches Canada’s First Online “Do-it-Yourself” Mortgage

You’re probably familiar with do-it-yourself (DIY) projects around the home – these can range from small art projects to full-blown renovations. One benefit of any DIY project is that you learn something new while adding a personal touch to your home. The point of a DYI project, however, is to save money on something that you, otherwise, would’ve had to pay someone else to do.

Now, what if there was a way you could DIY some of your finances? intelliMortgage Inc. thought this was a concept that needed to come to life and, as a result, they’ve launched the first-ever online DIY mortgage in Canada. With their unique “Mortgage Builder”, qualified borrowers can now pick and choose the exact features they need from their mortgage, to save time and eliminate elements that inflate interest costs.

How to Use the Mortgage Builder

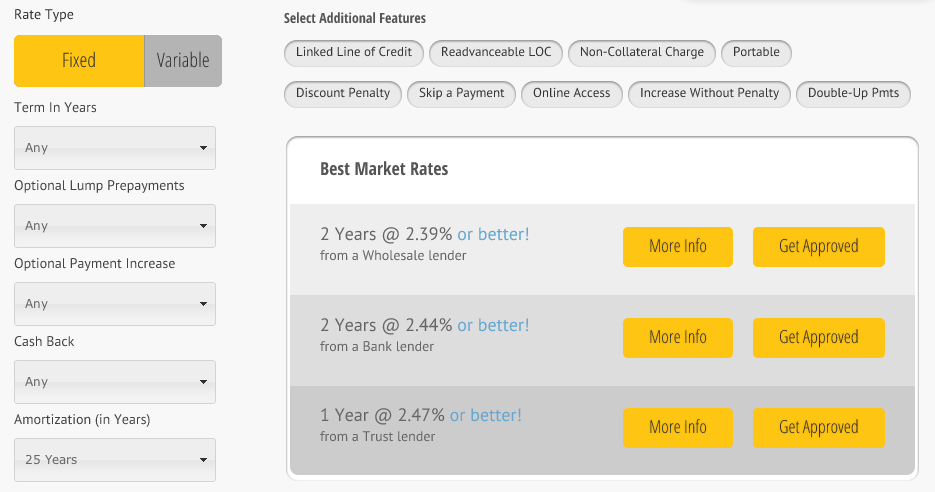

To start, simply enter your mortgage amount, the property value, the closing date, the type of mortgage you’re looking for and the province you’re purchasing the home in. The Mortgage Builder will then search all major banks, credit unions and wholesale lenders, to pinpoint the most competitive lender that matches your criteria and show you the best market rates based on your search.

From here, you can pick and choose the exact features you want included in your mortgage contract. As you select each option, you’ll notice that the best market rates may change slightly, which can be both an eye-opening experience (showing you which features inflate your interest costs) and a powerful influencer of your decision-making.

The Mortgage Builder then puts you in contact with a licensed intelliMortgage concierge, who will support you throughout the “do-it-yourself” process via phone, email or live chat. As a client, you will also be able to log into your account 24/7, to upload any completed documents and get instant status updates on the approval of your mortgage financing.

The intelliMortgage AmKiller

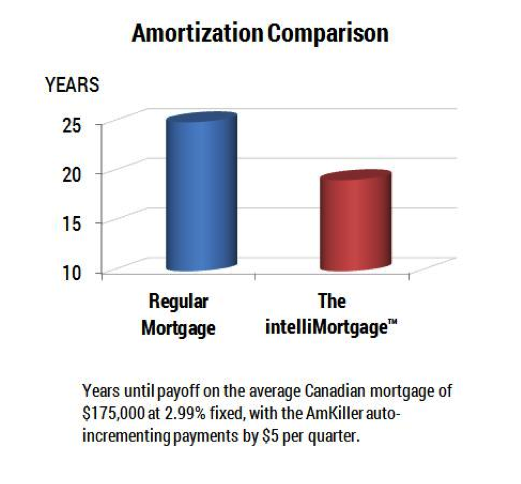

If your goal is to become mortgage-free fast, intelliMortgage also offers clients the exclusive “AmKiller” – a patent-pending feature of the intelliMortgage brand mortgage. By allowing intelliMortgage to automatically increase your payments by tiny amounts, at a frequency determined by you, the AmKiller can considerably reduce your effective amortization.

“Many don’t grasp how a payment increase of even $5 per quarter can cut off 5-to-6 years from the life of a mortgage,” says intelliMortgage co-founder Rob McLister. “AmKiller is a set-and-forget strategy so that lack of prepayment discipline stops being an obstacle to interest savings.”

We’re excited to partner with intelliMortgage and offer the first-ever DIY mortgage product on our website today – March 12, 2014. “Canadians are smarter than ever when it comes to selecting the optimal mortgage, using sites like Ratehub.ca to research their options,” notes McLister. “If they can choose their own investments, they can choose their own mortgage.”

Our thoughts exactly.