How much will it cost to break my mortgage with TD Bank?

Alyssa Furtado

This piece was originally published on April 20, 2020, and was updated on December 30, 2022.

Sometimes, you’ll find yourself in a situation where you have to break your mortgage term early. It could be to refinance your mortgage, transfer it to another lender with better mortgage rates, or to sell your home.

If this happens, you’ll likely have to pay a penalty fee, also known as a pre-payment penalty, or pre-payment charge. While each bank has their own penalty calculators on their websites, they’re often convoluted, over-simplified, or don’t explain exactly how they determine the amount you will owe them.

That’s why we created our own set of tools to find out how much it costs to break a mortgage with different banks. Here’s what you need to know about breaking a mortgage with TD Bank, and how much it will cost you.

What is a pre-payment penalty?

A pre-payment penalty is a charge issued to you by a lender if you break a mortgage with them. A mortgage is a financial contract, and the pre-payment charge is your mortgage provider’s compensation for you leaving early. Because there are several variables in the calculations, pre-payment penalties can vary greatly, even from the same lender.

Looking to refinance your mortgage?

Check out the lowest interest rates available right now!

Calculating your mortgage penalty

To help you understand how your pre-payment charge is calculated, we’ve created a mortgage penalty calculator of our own. To do so, we called all the banks to find out exactly how their calculations work, and built a list of other fees you may have to pay during the process. So, if you’re a TD mortgage customer who is in this situation, here’s how your penalty will be calculated.

Depending on if you have a fixed- or variable-rate mortgage, TD will charge you one of two fees:

- Three months’ interest, or the

- Interest rate differential (IRD).

If you have a variable rate mortgage, you’ll pay three months’ interest. If you have a fixed-rate mortgage, however, you will pay the greater of the two options. Here’s how they both work.

Method 1: Three months’ interest

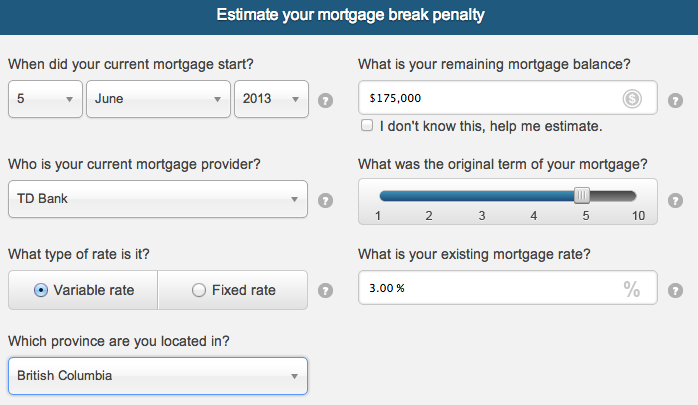

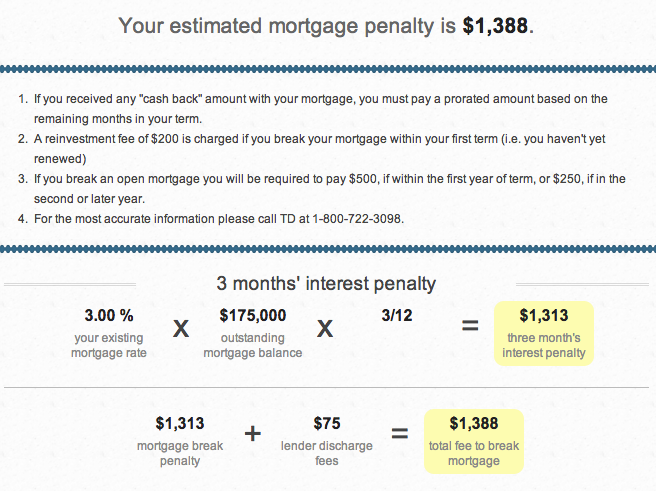

Three months’ interest is exactly what it sounds like: it’s the amount of interest you would have paid during a three-month period of your existing mortgage term. Let’s look at an example we put through our penalty calculator.

If you still owed $175,000 on your mortgage, three months’ interest would be calculated by multiplying the interest rate (we used 3.00% as an example) by the balance of your mortgage and again by 0.25 (represented as 3/12 for the three-month period out of the year). As you can see, that amounts to $1,313. However, one of the fees you’ll have to pay on top of this is a discharge fee. In British Columbia, TD’s discharge fee is $75, so we added that into our calculation.

In this example, because you had a variable-rate mortgage, TD would charge you the three months’ interest penalty fee of $1,313 + $75 to discharge your mortgage for a total of $1,388.

Method 2: Interest rate differential (IRD)

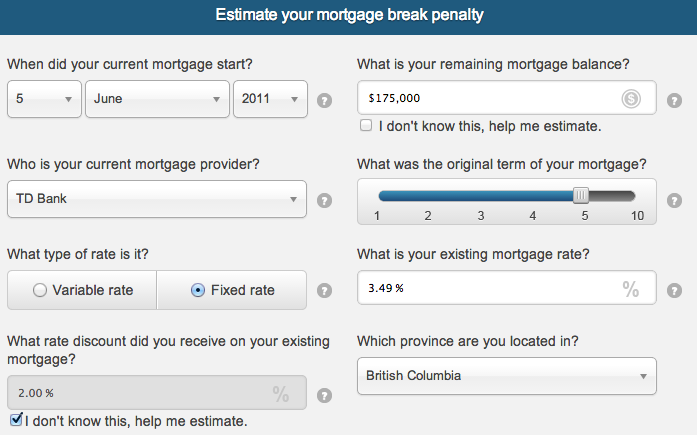

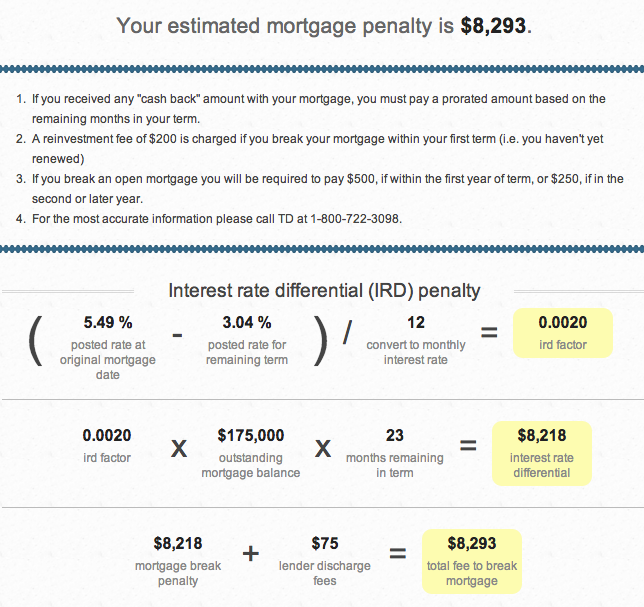

With the interest rate differential, TD would look at the difference between two interest rates, how many months you had left to pay off your current mortgage term, and finds the amount of interest they would lose by letting you break your term early.

But here’s where things get tricky. Instead of looking at your current interest rate, TD finds the posted rate from the day you signed onto your existing term. The bank then finds the difference between that rate and the posted rate for a product that would cover the remainder of your term today. These numbers aren’t always easy to find – this is why we built our calculator!

Using the same numbers as in our example above, let’s say the balance of your mortgage is $175,000 and you have 23 months left in your term. TD would first find a product that would cover the remainder of your term – in this case, you would need a 2-year fixed rate mortgage, because TD would round up 23 months to two years. Then, the bank would find the difference between the old posted rate (which was 5.49%) and today’s posted rate for a 2-year fixed rate mortgage (let’s use 3.04% in our calculation). The interest rate differential calculation would look like this:

In this example, because you had a fixed-rate mortgage, TD would charge you the greater of three months’ interest or the interest rate differential (IRD). Since we know three months’ interest was only $1,313, you would have to pay the IRD, which is $8,218 + $75 to discharge your mortgage for a total of $8,923.

Looking to refinance your mortgage?

Check out the lowest interest rates available right now!

Other TD Bank mortgage penalty fees

While our calculator gives you a good estimate of what your mortgage penalty will be if you break your term early, TD may charge you any number of other additional fees.

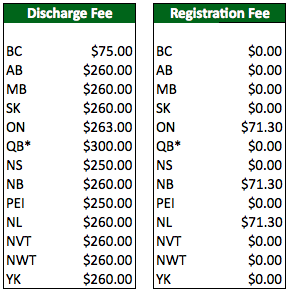

The first is the discharge fee, which we’ve included in our calculator, and it varies from province to province. As well, if you have a mortgage in Ontario, Newfoundland or New Brunswick, you will also have to pay TD $71.30 to register the new title. In all other provinces, you will have to pay this either through your real estate lawyer or directly at your municipal land title office.

If you happen to pay off your entire mortgage during your first mortgage term, TD will charge you a $300 reinvestment fee. And if you ever decide to transfer your mortgage to another lender, you will be subject to an assignment fee, as well.

Finally, if you took out any cash back when you entered or renewed your mortgage, TD may you ask you to pay back a portion of it, which they call a “cash back reimbursement”. The calculation for this is as follows:

Original cash back amount x (# of months remaining in term when you break your mortgage / # of months in original term) = Cash back reimbursement

So, if you got $5,000 cash back and you broke your 5-year (60-month) mortgage term 12 months early, you would have to pay TD:

$5,000 x (12 / 60) = $1,000

*Note: In Quebec, you will pay all other fees through a notary. It’s also important for all mortgage holders to remember that you may need to pay a notary or real estate lawyer to complete the entire transaction around breaking your mortgage term early.

TD Bank pre-payment privileges

One way you can try to lessen your mortgage penalty is by taking advantage of TD’s pre-payment privileges. The bank allows you to make one or more lump sum pre-payments of up to 15% of your original principal every year, so you could try to make one right before breaking your mortgage, to see if it would lower your penalty. As well, throughout your term, TD will allow you to increase your mortgage payment amount by up to 100% of your original mortgage payment amount each year.

The bottom line

Whether you use the pre-payment calculator on TD’s website or our mortgage penalty calculator, you need to know how much you’ll be charged to break you mortgage. Breaking a mortgage with TD Bank, or any lender, is sometimes a good financial decision, but only if you’re armed with all the information you need. Our pre-payment calculator, along with other tools like our mortgage affordability calculator, mortgage payment calculator and amortization calculator are a big part of this, and make it easier for people like you to make the best financial decisions.

Also read: