Does the home buyers plan actually help first-time buyers?

This blog was first published in 2020, and was updated on April 15, 2024.

UPDATE:

On April 11, 2024, the Federal government announced an expansion to the withdrawal limit for the RRSP Home Buyers’ Plan, to $60,000 from $35,000. This will go into effect on April 16, 2024. This is the second time the withdrawal limit has been increased since it was introduced in 1992; it was last updated from a limit of $25,000 in 2019.

The new measure will also extend the amount of time home buyers have before they need to start making repayment instalments, to five years from the current two, for those who make HBP withdrawals between January 1, 2022, and December 31, 2025. Check out our blog to learn more about the government’s announcement.

The Home Buyers’ Plan (HBP) is a federal government program that helps first-time buyers purchase their first home. As a first time home buyer, you can borrow up to $60,000 from your RRSP to use toward a down payment on your house. If you borrow, you must repay the savings to your RRSP in annual installments over the following 15 years. Alternatively, you can pay tax on the funds at their marginal rate. If you’re buying a home with a partner and you both qualify as first-time buyers, then you can access a maximum of $120,000 together, assuming those funds have been saved in an RRSP for a minimum of 90 days.

If you’re using the HBP, It’s important to account for the financial burden of paying it back on top of making your mortgage payments. It can be tough on a new homeowner budget. While making a larger down payment reduces the size of monthly mortgage payments – Canadians must pay at least 5% down, but it’s advised to put at least 20% toward a home – making a larger payment is less likely among the first-time buyer segment, especially in Canada’s priciest cities.

Has the HBP kept up with rising home prices?

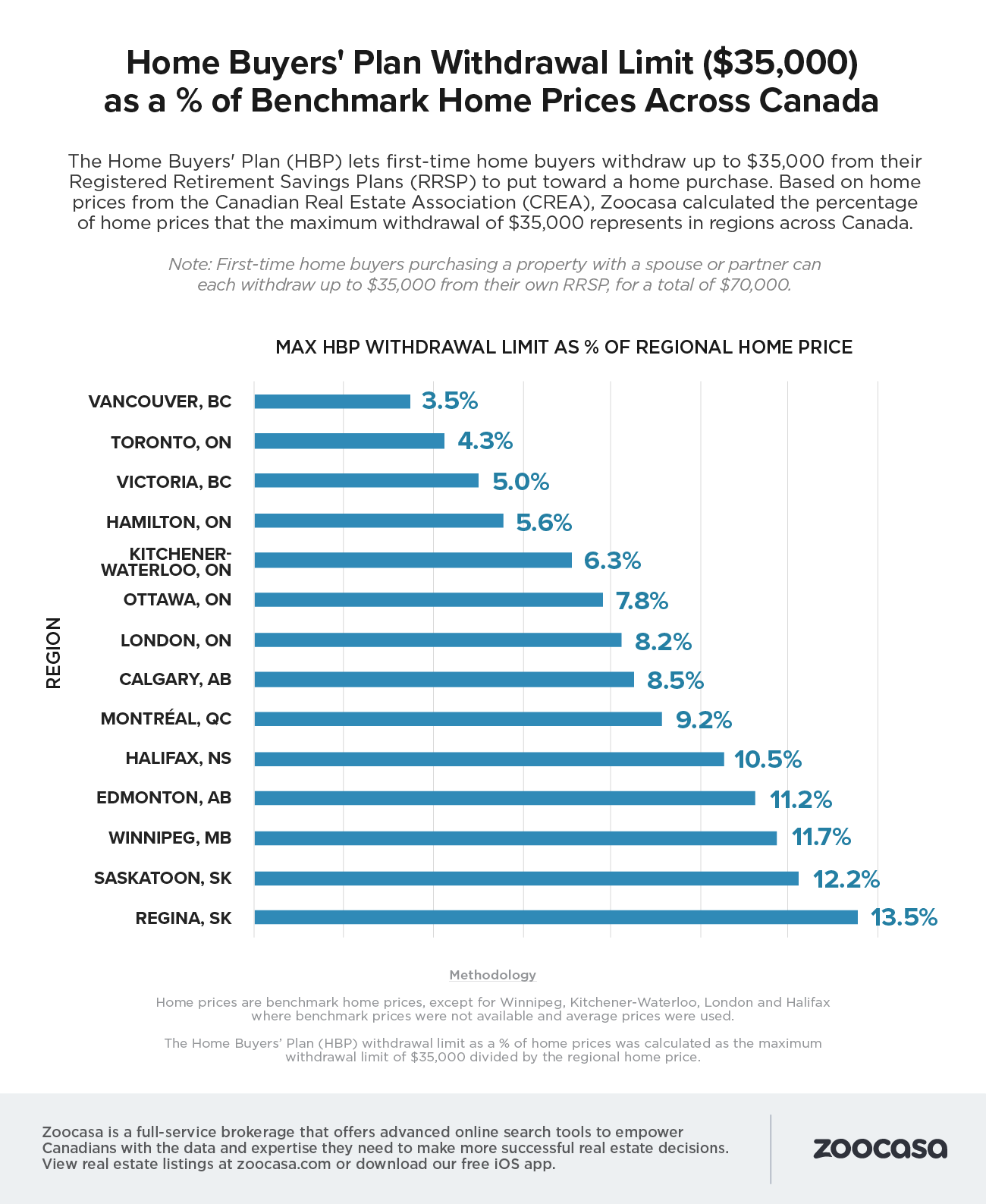

One of the biggest criticisms of the HBP is that, as property prices have soared in Canada’s major urban centres, those RRSP savings may not go very far.

Even if one has managed to save $60,000 in their RRSP (no easy feat in itself), that only equals 3.5% of the average property price in Vancouver, and 4.3% of the benchmark price for Toronto real estate. However, HBP funds will go much further in smaller urban centres where homes remain under $500,000, such as Waterloo homes for sale or houses for sale in Hamilton.

HBP goes furthest in the prairie provinces

As well, the Prairie provinces are especially notable for their low property prices. Withdrawing the full HBP amount of $60,000 in Regina, Saskatoon, Winnipeg and Edmonton would let buyers put down a much more comfortable down payment of 11-13.5% on the average home price. If two individuals are buying together and have saved up the full allowable $120,000 in their combined RRSPs then it’s even possible to put down the recommended 20%.

Other more affordable cities include Halifax, Montreal and London, Ontario where a full HBP withdrawal would equal between 8% and 10.5%.

Buyers should explore all savings options

It’s likely that first-time buyers will have to access other forms of savings besides the HBP. Some first-time buyers may in fact have the funds available in their RRSP but choose to leave it in there, preferring to focus on retirement plans and instead choosing to save in a non-registered account or a TFSA, which offers far greater flexibility.

Ultimately, saving up for a down payment is hard — no matter which account it comes from

Check out the infographic to learn in which city your HBP plan will go the farthest

Zoocasa is a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download our free iOS app

ALSO READ