December home prices rose across Canada: CREA

Property prices grew steadily this December across Canada, past the rate of inflation. Benchmark prices rose 3.4% in the last 12 months to $643,700 in the 19 markets the Canadian Real Estate Association (CREA) tracks. (CREA prefers to use benchmark prices instead of averages because it’s a more accurate reflection of the typical home price because it excludes the highest and lowest prices.)

When we look at the average price, we see a far greater upswing with prices climbing 9.6% year over year to $517,000.

With either metric it’s clear that the national market has largely recovered from its slump in late 2017 through early 2019.

That’s likely because demand so far outstrips supply that it’s putting upward pressure on prices. Whereas supply is at a 12-year low, with just 4.2 months of inventory left from a national perspective, sales are up 22.7% in December 2019 to December 2018.

But Canada is a big country and all real estate is local. Each region is faring quite different.

Ontario is leading the pack with price growth

Ontario continues to experience the greatest price growth of all provincial markets. Smaller urban centres are doing particularly well, presumably because houses are still affordable and millennials want to get in the game before being priced out. A few years ago, small southwestern Ontario cities homes sold for $300,000. Now, a catch-all from the overflow of Toronto, homes are selling closer to, or even over $500,000.

The London St. Thomas Association of Realtors reports that London, Ontario real estate jumped an incredible 16.1% to an average selling price of $426,539.

Homes for sale in Ottawa posted the best gains across any of the markets CREA tracks, rising 12.26% to $450,900, with five-year gains of 33.92%. Guelph real estate jumped 7.03% to $570,700, with five-year gains of 56.29%.

Ontario is currently a sellers’ market. This means buyers face increasing pressure to up their bids, leave out conditions in their offers and may settle buying their third or fourth choice of property.

British Columbia is expensive, but a mixed bag

Vancouver is still one of the most expensive cities in the nation, with a benchmark price of $1,017,300. While prices have dropped -3.19% from 12 months ago, they’re still up 53.65% in the last five years, indicating any price wobbles are a short-term result of the vacancy and foreign buyer taxes implemented in 2017.

Vancouver is currently experiencing a market balance. Neither seller or buyer holds the upper hand.

Elsewhere in British Columbia, home prices posted year-over-year gains, such as in the Okanagan Valley and Vancouver Island, which both rose 4.2% to $517,100 and $504,300, respectively.

Prairies continue to decline

The Prairies are the only region in Canada in which prices have sustained any sort of decline. It’s clear that this issue is limited to this region. They overbuilt a few years ago and is now experiencing an oversupply of housing. At the same time, demand has lessened due to economic woes because of low oil prices.

Buyers definitely have the upper hand here. They’re able to negotiate prices, have their pick of properties and add in favourable conditions to their offer.

Calgary (-1.1% to $417,400), Edmonton (-2.09 to $317,700), Regina (-4.52% to $260,700) and Saskatoon (-1.36% to $288,100) all posted losses from 12 months ago, and are also down around 10% from five years ago.

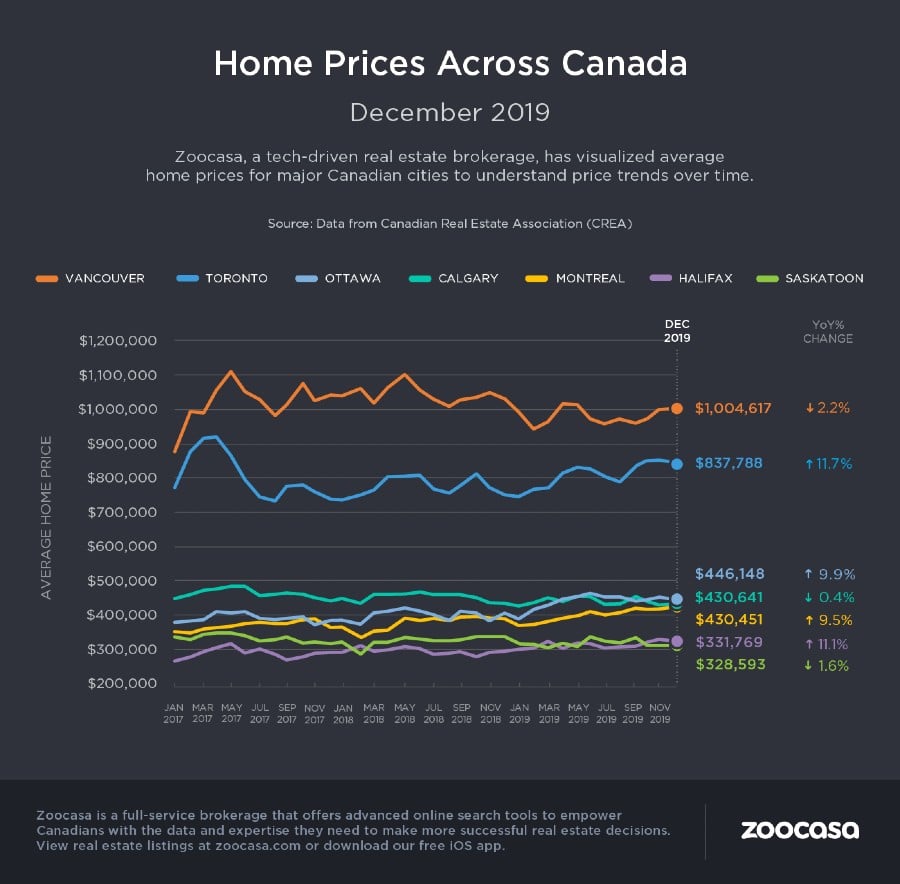

Check out the infographic for Canada’s December housing market.