CIBC Aeroplan Mortgage: are the points worth it?

A friend of ours, Erin Bury, is in the market for a mortgage. She’s considering a few different products including the CIBC Aerogold mortgage, and reached out to Ratehub.ca to see if we knew anything about it. Always on the lookout for the best deal, this was a mortgage we wanted to learn more about. Here’s what we found…

Whenever you are considering a promotional mortgage from a bank or lender, you need to determine if the benefits, in this case the value of the Aeroplan points, outweigh any additional costs which are buried in a higher interest rate. Let’s look at each now:

1. THE BENEFIT: AEROPLAN POINTS

The formula for the benefit then becomes:

BENEFIT = [15,000 points + (interest over term * 1 point)] * Dollar value of a point

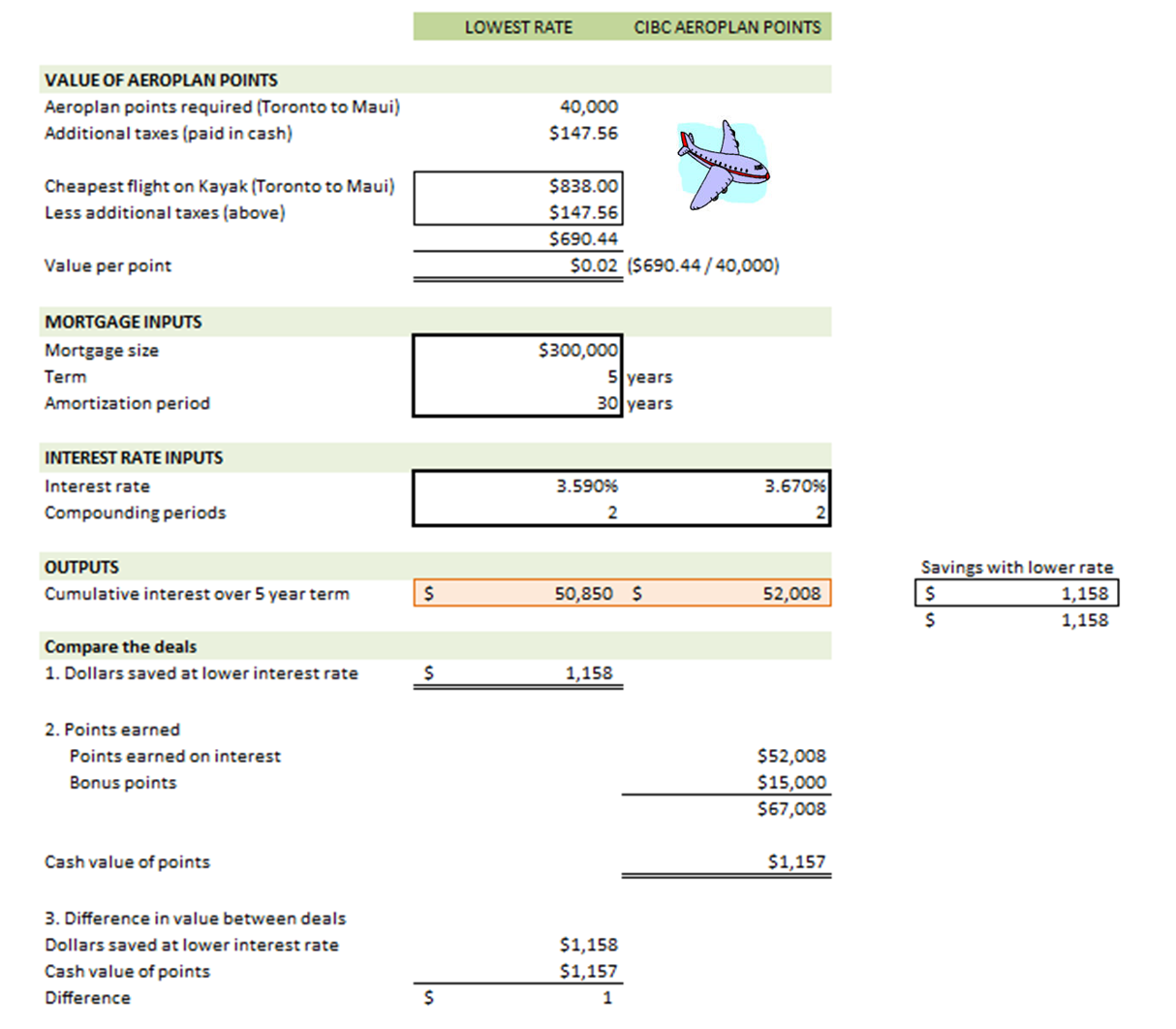

We decided to calculate the approximate dollar value of a point using a flight from Toronto to Maui (a favourite Ratehub.ca destination), and as you will see in our spreadsheet at the end of the article, one point is equivalent to around 2 cents.

1. THE COST: HIGHER INTERST RATE

Comparing offers between banks can be difficult as they rarely list their best mortgage rates. What we’ve done instead is start with our lowest 5-year fixed rate available at 3.59% and then calculated what interest rate CIBC would have to offer on the Aerogold mortgage to make us indifferent to the two offers.1 This way, if you go into a negotiation with CIBC, you know the point at which you should walk away.

In Excel, we calculated the point at which the dollar value of the interest saved by going with the lower rate is equal to the dollar value of the points earned at the higher AeroMortgage rate.

As you see in our summary below, on a $300,000 mortgage with a 5-year term and a 30-year amortization period, CIBC would have to offer us 3.67% on the Aerogold mortgage to compete with the lowest rate of 3.59%. Any higher than 3.67%, and we are kissing those points, and the “free” flight to Maui goodbye. According to the CIBC website on June 15th 2011, we can see rates start as low as an advertised 5.39%. It is highly unlikely you would be able to negotiate down to 3.67% from that starting point. Sorry CIBC, with high rates like that, we will be paying for our flight with the cash we save in interest payments.

1 This assumes you are indifferent to cash and points. In reality, cash has a higher value as it comes with full flexibility.