5 creative ways to save money as a renter in Toronto

If you’re already a renter in Toronto, chances are a large percentage of your income is going toward rent and other living expenses. And while there’s little we can do to change the ever-increasing prices of the market, we do have a few handy habits, tips, and tricks up our sleeve to help you save more money. From learning negotiation tactics to learning how to maximize your tiny condo space, here are five creative ways to save money as a renter in Toronto.

Are you looking for the best tenant insurance rate?

Get a free quote for cheap tenant insurance designed specifically for your rental needs. Make sure your personal property is protected today.

Negotiate when you sign a lease

Rather than accepting the inflated price of rent, attempt to negotiate to save on this monthly expense. The following tactics could swing you a discount on your next lease.

- Sign a longer lease: A landlord wants stability, and you have the power to give them that peace of mind by signing an extended lease of a year-and-a-half or two years. The longer the lease, the lower the landlord should be willing to go. It costs them money and time to move you out and bring someone else in and this grants you a bit of leverage. Research similar apartments in the area and come prepared with a number in mind but remember who you’re dealing with, as independent landlords are a lot more flexible than property management companies.

- Look in the winter: Landlords have a tough time finding renters during the winter and vacancies can go on for months. With college graduates flooding the market and families with children in elementary school not wanting to uproot their kids until the end of the school year, there is a huge increase in demand (and thus price) in the summertime. By looking for apartments in the winter, and even offering to sign an extended lease that ends in the summer to ensure you leave at a good time in the market, the landlord will likely be willing to work with you on a tradeoff.

- Leverage the house’s flaws to lower the rent: Use the open house or the viewing appointment as an opportunity for inspection. Pay close attention to the details, as minor flaws like chipping paint are the landlord’s responsibility to keep up. If the place doesn’t live up to the standard, ask to have these flaws deducted from the rent price.

- Do your own maintenance: If you fancy DIY activities and know your way around the hardware store, then perhaps try taking on the challenge of fixing things yourself. Propose the idea to your landlord that when things get broken, you will repair them if they deduct the maintenance fee from your rent.

- Pay up front: If you have enough saved up, you can offer to pay the entire lease or at least a few months up-front for a discount. Your landlord may be likely to cut a deal to have cash in hand. However, if you do pay upfront, make sure to remember to put money back into your savings each month.

Buy used or cheap

While Yorkdale’s Restoration Hardware or Liberty Village’s West Elm can give us serious feels, we should use these stores as an inspiration, not as a solution. When furnishing a rented apartment, it’s important to keep in mind the fact that you are a temporary renter. You will soon move on to new places and new things and your furniture selection for this specific place should also be temporary, inexpensive, and practical. Buy reasonably priced and minimalistic furniture from the stores like IKEA, Walmart or H&M Furniture department. Better yet, hit Kijiji, Facebook Marketplace, or Craigslist to put your new haggling skills to the test one more time and save even more.

Maximize your space with off-site storage

Once you’re all moved into your new Toronto regulation size 200 square foot condo, you’ll not just want but need to maximize the space you have available. Items like your puffer coat, Uggs, and scarves out-of-house blankets take up so much precious closet and storage space in the summer time. Companies like Second Closet pick up, store and return your stuff, starting at just $3 a month. Unlike traditional self-storage companies, Second Closet is a great way to free up space, while still keeping items in your possession.

Be savvy about utility consumption

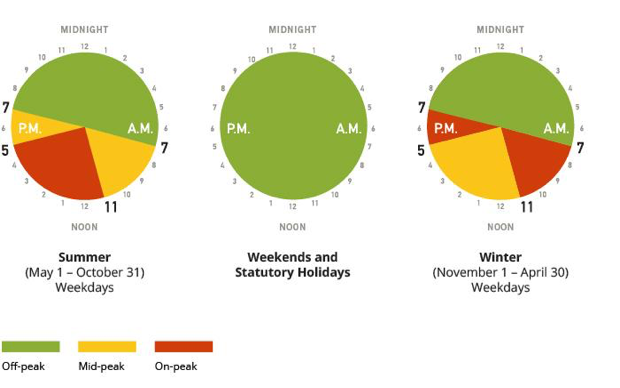

Simply shifting your electricity usage to times when electricity is cheaper can significantly lower your electricity costs. According to the Ontario Energy Board, you pay less for electricity if you use it during off-peak times when demand for electricity is lowest. The chart below lays out the cheapest and most expensive time to use electricity according to the off-peak and on-peak times.

Other habits that will decrease your next utility bill are:

- Using energy-efficient light bulbs

- Incorporating fans to help reduce your AC usage

- Turning off and unplugging all the devices that can consume the energy in a passive way

Borrow or rent items instead of buying

The sharing economy is in. Airbnb lets anyone rent out a room. Uber lets anyone become a taxi driver. And there are plenty of other apps that can make you money and save you space, while also benefiting others.

All those items that sit gathering dust in your forgotten drawers like a drill or a blender can now be rented out to others.

So the next time you’re looking at that $500 Vitamix, consider apps like BURO, Quupe, and the Good Neighbour that let Torontonians 1) save money by renting rather than buying items like professional cameras or tools and 2) make you money if you rent out items to others.

Also, don’t forget the free options! Like borrowing a suitcase from a friend if you rarely travel or hitting up your local library instead of buying your next book.