[FAQ] Canada’s Top Loyalty Programs – Your Questions Answered

There’s no question about it: investing in a credit card rewards program is one of the best ways to earn major discounts and save on everything from flight tickets and hotel rooms to cruises, restaurants, and more.

Where the real questions arise is around the specifics of each loyalty program: “How much are rewards points really worth?”, “How can I redeem points?” and of course, “Which rewards program is best for me?”

With that in mind, Ratehub.ca has created this handy FAQ to answer your burning questions about some of the most popular credit card loyalty programs in Canada.

Find your perfect credit card in under 60 seconds - No SIN required

Tell us a bit about yourself

Answer some questions so we can personalize our recommendations - this won't impact your credit score

Check your eligibility

We confirm your eligibility with our partner, TransUnion. This will be a ‘soft credit check’ which you can see but lenders cannot

Find your perfect matches

We show you the cards you’re most likely to want and most likely to get

Best Loyalty Programs in Canada

- Aeroplan

- Air Miles

- American Express Membership Rewards

- BMO Rewards

- CIBC Aventura

- MBNA Rewards

- Marriott Bonvoy

- Meridian Rewards

- National Bank Rewards Points

- RBC (Avion)

- SCENE

- Scotia Rewards

- TD Rewards

- Triangle Rewards

Aeroplan

Note: The Aeroplan program is changing effective November 8, 2020. Click here for details about the new program and here for information about new co-branded Aeroplan credit cards.

One of Canada’s oldest loyalty programs at 35 years old, Aeroplan was first launched as the dedicated frequent flyer program of Air Canada. Today, Aeroplan is owned and operated by Aimia Inc. and has over five million active members who can earn and redeem their miles for flights on over two-dozen airlines as well as hotel stays, merchandise, gift cards, and more.

As of January 2019, Air Canada finalized its purchase of Aeroplan back from Aimia Inc., and will wholly take control of the loyalty program in 2020.

Q: How do you earn Aeroplan miles?

A: TD, CIBC, and American Express each issue travel credit cards that are associated with the Aeroplan program.

Aeroplan credit cards typically offer 1 mile for every $1 in purchases, however, you can stand to earn a higher number of miles per dollar on some purchases when using select cards. One such example is theTD® Aeroplan® Visa Infinite*

TD® Aeroplan® Visa Infinite* Card, which offers 1.5 Aeroplan miles for every $1 spent at groceries, gas stations, pharmacies, and for purchases made on Air Canada’s website.

TIP:

- You can get twice the miles (or more) when you shop from Aeroplan partner stores by using your Aeroplan credit card while simultaneously presenting your Aeroplan Membership Card, or by shopping from the Aeroplan eStore.

Q: What is the dollar value of an Aeroplan mile?

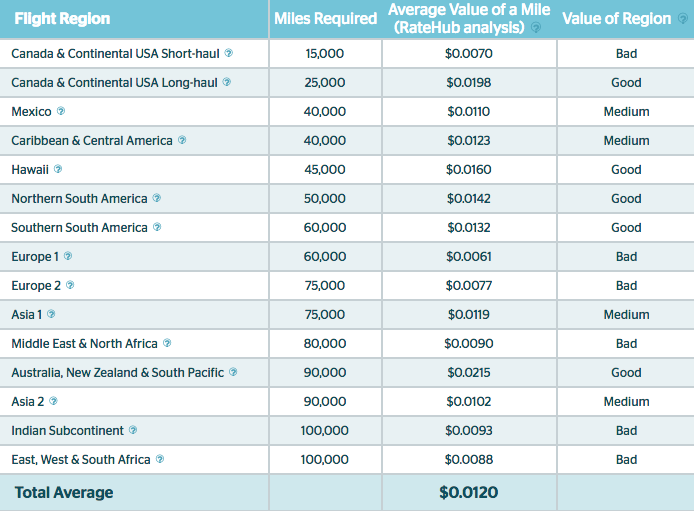

A: According to our calculations, the dollar value of 1 Aeroplan mile is approximately $0.0120 when redeemed for travel. It’s important to note, however, the value of miles is not consistent and can vary depending on which region of the world you’re flying to. For example, 60,000 Aeroplan points can be worth $792 or $366 based on whether you redeem your miles for a flight to Brazil or Italy respectively.

TIPS:

- Aim to redeem your miles for flights to regions where the “Average Value of a Mile” is equal to or above $0.0120, such as the Australia, New Zealand and South Pacific region or on long haul flights to the continental USA. This is the most effective way to ensure you avoid redeeming your miles for anything below their average value.

- If your travel plans include a flight to a region of the world where the “Average Value of a Mile” is below $0.0120, consider purchasing the flight ticket outright and banking your miles to redeem for another trip to a more high-value region.

- Do you have flexible travel plans? If so, you may want to consider including one or two additional stopovers. That way, you could fly to several cities as part of one travel redemption, and, as a result, get more value out of your points (Aeroplan allows for a maximum of 2 stopovers).

Q: What can you redeem Aeroplan miles for?

A: Aeroplan miles can be redeemed for airline tickets through the Aeroplan App, which is available on both Android and iOS devices. If you’d like to use your points for rewards besides airline travel, you can also log into the Aeroplan website to redeem points for everything from:

- Flights, hotels, vacation packages, car rentals, and cruises.

- Entertainment, including dining and events, spas and getaways.

- Gift cards and merchandise for electronics, fashion and accessories, personal care, home and garden items, and more

- Donations to a charity or to Aeroplan’s Green It Up program to reduce your carbon footprint.

TIP:

- Try and resist redeeming your Aeroplan miles for anything other than flight tickets. While merchandise and free hotel stays may be tempting, they tend to offer significantly lower value for your points when compared to flight redemptions.

Q: What is Aeroplan’s policy regarding expiring miles?

A: Aeroplan miles do not expire for active members. However, if your account is inactive (meaning, you don’t use your Aeroplan credit card or redeem miles at least once over a 12 month period) your points will expire. Rest assured, keeping your account active is easy, as you only have to make a purchase on your card or redeem miles once a year.

For extra measure, you can check the expiry status of your miles by logging into your online Aeroplan membership profile. Aeroplan will also send you an email notice around 10 to 12 weeks in advance of the date your miles are set to expire to ensure you don’t lose out on the opportunity to redeem them.

Q: Can Aeroplan miles be used to pay for taxes and fees?

A: Yes, you can use Aeroplan miles to cover taxes and fees. The one caveat is that the value of your miles may be affected.

Q: Can you use Aeroplan miles retroactively?

A: Aeroplan miles cannot be applied retroactively at a later date and must be redeemed at the time of your purchase.

Q: Which airlines are affiliated with the Aeroplan program?

A: Aeroplan members can redeem their miles on Air Canada flights as well as any of the 26 other airlines that are part of Star Alliance, including United Airlines and Lufthansa to name a few.

Q: Can Aeroplan miles be transferred to other loyalty programs?

A: Miles can be transferred from one Aeroplan account to another at a rate of 2 cents per mile. In addition, Aeroplan can be converted to a number of other loyalty programs, including:

- American Express Membership Rewards: 1,000 points = 1,000 Aeroplan miles

- Best Western Rewards: 5 points = 1 Aeroplan mile

- Hilton Honors: 10,000 points = 1,000 Aeroplan miles

- CIBC Aventura: 10,000 points = 10,000 Aeroplan miles

- Marriott Bonvoy: 3 points for 1 Aeroplan mile

Q: What about all the changes to the Aeroplan program in 2020?

There was no shortage of headlines covering the Aeroplan program in the past year, specifically about changes in the program’s ownership and its potential split with Air Canada. Here’s a quick recap to bring you up-to-date on the future of the program (which, by all accounts, looks bright).

In January 2019, news broke that Air Canada would buy Aeroplan back from Aimia Inc., and take control of the loyalty program in 2020. Following this announcement, Air Canada confirmed it would maintain the value of Aeroplan points after the transition in ownership, so Aeroplan members can rest easy knowing their miles won’t drop in value regardless of any re-branding that may occur to the program post-2020. Recent news of a deal between Air Canada and Air Transat suggests Aeroplan members may soon be able to redeem their miles on Air Transat flights sometime in the near future, though, details aren’t yet confirmed and this remains as speculation for now.

Q: What does Ratehub recommend as the best Aeroplan credit card?

A: TD® Aeroplan® Visa Infinite* Card.

- $139 annual fee (rebated for the first year)

- Earn 1.5 Aeroplan points per $1 on eligible gas, groceries, and direct through Air Canada purchases

- Earn 1 point per $1 on everything else

- Apply by March 6, 2022 to earn up to $1,250 in value (assuming you take one round-trip Air Canada flight and add an Additional Cardholder to your account in the first year) as follows:

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†

-

Earn an additional 15,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†

-

Earn a Bonus Buddy Pass† that can score you a second ticket when you book an economy ticket. On the second ticket, you only pay the taxes and third-party charges. You’ll receive the one-time use pass when you spend $1,000 within 90 days of Account opening†, and you have a whole year to use it†

- Enroll for NEXUS and once every 48 months get an application fee rebate†, and share free first checked bags†

- This offer is not available for residents of Quebec. For Quebec residents, please click here.

- †Terms and conditions apply.

- Income required: $60,000 (personal) and $100,000 (household)

Air Miles

Launched in 1992, AIR MILES has over 10 million active collector accounts worldwide and is one of the most commonly-used travel rewards programs in Canada.

Q: How do you earn Air Miles?

A: BMO and American Express offer a number of credit cards that allow you to earn Air Miles on a per-dollar basis on all your everyday purchases. Air Miles credit cards offer anywhere from 0.05 to 0.1 miles for every $1 you spend depending on the card and the type of purchase being made.

You can also earn Air Miles without a credit card by signing up for an Air Miles Collectors Card, in which case you’ll earn points only when you present your Collectors Card at Air Miles partners stores such as Rexall, Sobeys, and Shell gas stations.

TIP:

- You can earn 2X the miles (for every $20 spent) at the program’s long list of retail partners when using your Air Miles credit card.

Q: How much is an Air Mile worth in dollar value?

A: According to our calculations, the dollar value of 1 Air Mile is approximately $0.121 when redeemed for travel.

However, the value of an Air Mile isn’t constant and can fluctuate based on where to (and what time of the year) you’re flying.

TIPS:

- To maximize the value of your Air Miles, try and redeem your points on flights where the redemption value is equal to or more than $0.121, such as on flights to North Eastern USA during high season.

- Try to schedule your travel plans for the summer, spring or winter, as you’ll typically reap a higher return from your miles on flights booked during high season. Below, we’ve provided the time-frames for high and low season according to Air Miles:

Low Season: January 8 – February 28, April 1 – May 31, September 16 – December 15

High Season: March 1 – March 31, June 1 – September 15, December 16 – January 7

Q: How do you redeem Air Miles?

A: Air Miles members can redeem their miles in one of two ways: as Dream Rewards or Air Miles Cash.

Dream Rewards are most synonymous with Air Miles and can be redeemed for airline tickets and other-travel rewards, such as hotel stays, vacation packages, and rental cars, as well as some merchandise and tickets to events. As mentioned above, we calculated the average value of 1 Air Miles Dream Mile to be around $0.121 – though multiple factors, such as your travel destination, can affect their redemption value.

Meanwhile, Air Miles Cash can act to subsidize your purchases and help you save on your grocery and shopping bills at a number of Air Miles partner stores such as Metro, Sobeys, Rexall, and Rona, among others. You can also use Air Miles Cash to get gift cards. Air Miles Cash can be redeemed at a rate of 95 miles for $10.

You can choose between either of these two options online on the official Air Miles website. Once redeemed, you cannot swap your Dream Rewards into Air Miles Cash or vice versa.

TIP:

- On a purely per-point basis, you get the most value out of your Dream Rewards when they’re redeemed for flight tickets compared to what Air Miles Cash offers.

Q: Do Air Miles expire?

A: Air Miles do not expire if you’re an active Air Miles member and will only be lost if an account is left inactive for 24 consecutive months.

Q: Can Air Miles be used to pay for taxes and fees?

A: While Air Miles Dream Rewards can be used to pay for fuel surcharges, you cannot use them to offset the cost of taxes or fees.

Q: Can Air Miles be used retroactively?

A: Unfortunately, miles can only be redeemed at the time of purchase and cannot be applied to purchases after the fact.

Q: Which airlines are involved in the Air Miles program?

A: Air Miles can be redeemed for flights on a handful of airline partners including Air Canada, American Airlines, British Airways, Lufthansa, Porter and more.

Q: Can you transfer Air Miles?

A: While some rewards programs, such as Esso and RBC, allow you to convert their points to Air Miles, the reverse isn’t true. It’s also important to note Air Miles cannot be swapped between Dream Rewards and Air Miles Cash.

Q: What does Ratehub recommend as the best Air Miles credit card?

A: The BMO Air Miles World Elite Mastercard.

Card details

- Annual fee: $120 (waived for first year)

- Earn 1 mile per dollar spent on all purchases

- VIP Airport Lounge Access* – Complimentary access to Mastercard Airport Experiences from LoungeKey

- Annual income requirement: $80,000

Find your perfect credit card in under 60 seconds - No SIN required

Tell us a bit about yourself

Answer some questions so we can personalize our recommendations - this won't impact your credit score

Check your eligibility

We confirm your eligibility with our partner, TransUnion. This will be a ‘soft credit check’ which you can see but lenders cannot

Find your perfect matches

We show you the cards you’re most likely to want and most likely to get

American Express Membership Rewards

The smallest of Canada’s three major credit card companies (whose list includes Visa and Mastercard), American Express issues a number of credit cards that offer American Express Membership Rewards points on a per-dollar basis. American Express Membership Rewards points are redeemable for everything from flight tickets on any airline (with no blackout dates) to merchandise, and more.

Q: How do you earn American Express Membership Rewards points?

A: Most American Express credit cards that are affiliated with the American Express Membership Rewards program offer between 1 to 2 points for every $1 spent on the card. However, depending on the card, certain purchases may be rewarded with more points.

TIP:

- One of the most effective ways to maximize how many American Express points you can earn is by picking a credit card that rewards you with the most points on your everyday purchases. That’s why we recommend the American Express Cobalt Card. This card consistently ranks as one of the best travel cards in Canada and offers 5 points for every $1 spent on groceries and restaurants, and 2 points for every $1 spent on travel-related expenses including gas, taxis, and public transit.

Q: How much is an American Express point worth in dollar value?

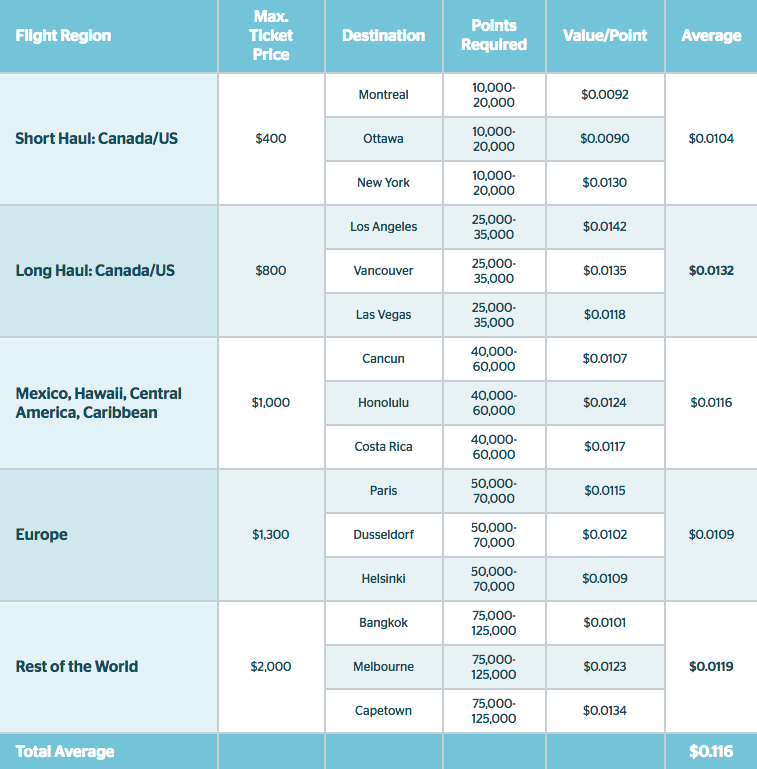

A: The dollar value of 1 American Express Membership Rewards Point is $0.01 (1%) for travel related-redemptions and $0.007 (0.7%) for statement credits. If you have enough points, you can also tap AMEX’s Fixed Points Travel Program to potentially get more value out of your points on round-trip flights.

Q: How do you redeem American Express Membership Rewards points?

A: You can redeem points by logging into the American Express Membership Rewards website, over the phone, or via the American Express App.

When booking travel, you can redeem points using either: 1.) the Flexible Points Travel Program or 2.) the Fixed Points Travel Program. While the two might sound similar, they operate quite differently and each has its own unique benefits.

With the Flexible Points Travel Program, you can redeem points as you like for everything travel-related (including one-way flights and hotels), and point values are straight-forward (1,000 points always equals $10 or 1%).

In contrast, the Fixed Points Travel Program isn’t as simple but is potentially more lucrative. This Program uses a chart (similar to Air Miles or Aeroplan) where each travel destination has a minimum required number of points that can be redeemed for a flight up to a “Maximum Base Ticket Price.”

Let’s look at an example: to fly to Europe, you’ll need no less than 60,000 points. You can redeem these points for a flight up to a “Maximum Base Ticket Price” (in the case of Europe, that’s $900). If you need to redeem for a more expensive flight, you can top off the difference using points or cash. Depending on the price of the ticket and flight destination, using the Fixed Points Travel Program will mean you can use fewer points per flight, letting you stretch their dollar value. That said, the Fixed Points Travel Program is far more restrictive and is only for round-trip flights out of Canada.

TIP:

- You’ll want to run the numbers when deciding which of these two travel redemption options is more cost-effective. In general, though, you’ll get better value from the Fixed Points Travel Program the closer a flight ticket is to the “Maximum Base Ticket Price”. If the cost of a flight is much lower than the “Maximum Base Ticket Price”, then the Flexible Points Travel Program may be the better choice.

American Express points can also be redeemed for:

- Travel and hotel gift cards from Air Canada, Fairmont Hotels and Auberge Saint-Antoine.

- Thousands of brand-name merchandise items across a number of shopping categories including electronics, kitchen, home and garden, and fashion at participating brands from Kitchen Aid and Cuisinart, to Dyson, Bose, Samsung, and more.

- Gift cards from merchants including Apple, Indigo, Roots, Sporting Life, Holt Renfrew, Winners, HomeSense, Marshalls, Henry’s, The Keg, Oliver and Bonacini and Esso.

- Event tickets from Ticketmaster or eligible purchases on Amazon.ca.

- Credits that can be applied towards your credit card statement balance.

Q: Do American Express points expire?

A: Points do not expire for active members. However, if an American Express credit card is cancelled and enrolment to the American Express program is withdrawn, points will expire after a one-month period.

Q: Can American Express points be used to pay for taxes and fees?

A: Yes, you can use points to cover the cost of taxes, fees, and surcharges.

Q: Can American Express points be used retroactively?

A: Yes, flight tickets can be purchased outright through an American Express credit card and redeemed using points as a statement credit at a later date (up to 3 months later via the web and 12 months later via the telephone).

Q: Which airlines are involved in the American Express program?

A: American Express points can be redeemed for flights on the airline of your choice.

Q: Can you transfer American Express points?

A: Yes. In fact, American Express has phenomenal transfer options with a number of the world’s most popular rewards programs including Aeroplan, Alitalia, Asia Miles, British Airways Executive Club, Delta SkyMiles, Etihad Guest, Marriott Bonvoy, and Hilton Honors, to name a few.

TIPS:

- You can convert American Express points to Aeroplan miles (which offer a higher dollar value per point) without having to pay any taxes or fees. We’ve calculated that you can boost the value of your American Express points by up to 20% through this strategic transfer.

- It’s important to note AMEX Membership Rewards points come in two different tiers: regular points and what are known as “Select” points. Unlike regular points, Select points don’t have as many transfer options and can only really be transferred to the Marriott Bonvoy program. An example of an American Express card with Select points is the American Express Cobalt.

Q: What does Ratehub recommend as the best American Express credit card?

A: The American Express Cobalt Card.

Card details

- Annual fee: $155.88 (charged at $12.99 monthly)

- Earn 5 points per dollar on restaurants, coffee shops, bars, grocery stores, and food delivery

- Earn 2 points per dollar on gas, taxis, public transportation and travel (air, water, rail, or road transport, plus hotels)

- Earn 1 point per dollar on all other purchases

BMO Rewards

BMO Rewards is the branded rewards program of the Bank of Montreal, the first official bank in Canada and one of the ten largest banks in North America. BMO Rewards points are earned with every purchase made through select BMO credit cards and can be redeemed for travel or merchandise.

Q: How do you earn BMO Rewards points?

A: BMO credit cards offer between 1 to 3 BMO Rewards points for every $1 in purchases.

Q: How much is a BMO Rewards point worth in dollar value?

A:1 BMO Rewards point is worth $0.007 when redeemed for travel.

Non-travel redemptions offer less value for your points.

Q: How do you redeem BMO Rewards points?

A: You must redeem points through the BMO Rewards website or by calling the BMO Rewards Centre (a $29.95 fee applies to bookings made over the phone). BMO Rewards Points can be redeemed for:

- Travel-related rewards including flights, hotels, vacation packages, and car rentals. When booking travel for more than six people, you must call the BMO Rewards Centre.

- A wide selection of brand-name merchandise including electronics, home and garden, kitchen, luggage and bags, fashion and accessories, health and beauty items, and more.

- Gift cards from dozens of merchants including Hudson’s Bay, Starbucks, Cineplex, Best Buy, The Keg, Indigo, Amazon, Canadian Tire, Winners, HomeSense, and Marshalls.

- Credit to be applied your card statement balance or as a contribution to a BMO investment account.

TIP:

- BMO Rewards has a price-match guarantee policy, so make sure to keep an eye out for lower-priced alternatives on applicable flights – it could end up saving you quite a bit of points.

Q: Do BMO Rewards points expire?

A: BMO Rewards points do not expire. However, if you voluntarily choose to close your account with BMO, you have up to 90 days to redeem your points before they are forfeited.

Q: Can BMO Rewards points be used to pay for taxes and fees?

A: Yes, BMO points can be used to pay for any applicable taxes, fees, and surcharges.

Q: Can BMO Rewards points be used retroactively?

A: Unfortunately, points can only be used at the time of purchase.

Q: Which airlines are involved in the BMO Rewards program?

A: From Air Canada to Delta Airlines, West Jet and more, you can redeem BMO points for flights on almost any airline of your choice.

Q: Can you transfer BMO Rewards points?

A: No, unfortunately, you cannot transfer points from one BMO account to another, or to other loyalty programs.

Q: What does Ratehub recommend as the best BMO Rewards credit card?

A: The BMO World Elite Mastercard.

Card details

- $150 annual fee (waived for the first year)

- Earn 3 BMO Rewards points per dollar on travel, dining and entertainment purchases; 2 points per dollar on everything else

- Earn 35,000 bonus points (value: $250) when you spend $3,000 in the first 3 months

- VIP lounge access with the included Mastercard Airport Experiences membership, plus 4 complimentary passes per year ($140 value)

- $Annual income requirement: $80,000

CIBC Aventura

CIBC Aventura is the official rewards program of CIBC, one of Canada’s big six banks. In addition to flights, CIBC Aventura points can also be redeemed for hotels, cruises, and vacation packages. Aventura points are not limited to airlines or by blackout dates.

Q: How do you earn CIBC Aventura points?

A: If you sign up for the CIBC Aventura VISA Infinite, you can earn Aventura points based on a sliding scale – with 1.5 points for every $1 you spend on gas, groceries, and pharmacies, and 1 point for every $1 spent on everything else.

TIP:

- You can earn an additional Aventura point for every $1 you spend towards your travel purchases (for a total of 2 points per dollar) when you book your trip through the CIBC Aventura Rewards Centre.

Q: How much is a CIBC Aventura Rewards point worth in dollar value?

A: According to our calculations, 1 CIBC Aventura Point is worth approximately $0.0116 when redeemed for travel. However, the value of points is not set in stone and can vary depending on where you’re flying.

CIBC Aventura splits the world into five different “Flight Regions,” as outlined below:

TIP:

- To get the most value out of your points, aim to redeem your CIBC Aventura points when the value of a point is close to or above $0.0116 – such as on long-haul flights in Canada or to the US.

Q: How do you redeem CIBC Aventura points?

A: Aventura points must be redeemed through the CIBC Rewards website or over the phone. Aventura cardholders can redeem points for:

- Flights on any airline (with the added flexibility of no blackout dates) as well as hotels, car rentals, vacation packages, and cruises.

- Hundreds of merchandise items from brands such as Dyson, KitchenAid, Le Creuset, Bose, Nikon, Weber, and Napoleon.

- Gift cards from dozens of merchants including Whole Foods, Longos, The Keg, Moxie’s Grill; Bar, Amazon, Best Buy, Hudson’s Bay, Saks Fifth Avenue, Rona, Home Depot, Starbucks, Roots, Indigo, and Holt Renfrew.

- Credits towards your CIBC credit card, personal line of credit balance or CIBC mortgage. Plus, points can be used contributions into a CIBC TFSA, RRSP, or Investor’s Edge portfolio.

- Auctions on unique events and experiences, such as a VIP Las Vegas trip for two or tickets to the Rockefeller Center Christmas Tree Lighting in New York City.

TIPS:

- Try and resist redeeming your Aventura points for anything other than air travel. While restaurant rewards or paying off your bills with points may be tempting, they offer significantly less value for your points on average.

- Read our blog post on How the CIBC Aventura Rewards Program Works for an-depth review of this loyalty program.

Q: Do CIBC Aventura points expire?

A: No, points do not expire for active member or inactive members. However, if an account is closed, points will be forfeited after 60 days.

Q: Can CIBC Aventura points be used to pay for taxes and fees?

A: Yes, Aventura points can be used to pay for any applicable taxes, fees, and surcharges.

Q: Can CIBC Aventura points be used retroactively?

A: No, points cannot be redeemed retroactively.

Q: Which airlines are involved in the CIBC Aventura program?

A: When redeeming points for flight tickets through the CIBC Rewards website, you’ll have access to hundreds of airlines including Air Canada, British Airways, and Delta Airlines, to name just a few.

Q: Can you transfer CIBC Aventura Rewards points?

A: Yes and no.

CIBC Aventura account holders who signed up before October 31, 2013, can transfer points to Aeroplan miles at a ratio of 1: 1. However, those who signed up after that date are out of luck and can’t transfer points to another loyalty program.

MBNA Rewards

MBNA Rewards is the official rewards program of MBNA, an independent credit card issuer whose Canadian portfolio of credit cards was purchased by TD in 2011. The MBNA Rewards program allows you to redeem your points for travel, cash back, merchandise, and gift cards.

Q: How do you earn MBNA Rewards points?

A: MBNA issues a number of credit cards that offer MBNA Rewards points on everyday purchases. Depending on the card, you can earn between 0.5 and 2 points for every $1 in purchases.

Q: How much is an MBNA Rewards point worth in dollar value?

A: 1 MBNA Rewards point is worth $0.01 (or 1%) when redeem for travel. If you choose to redeem your MBNA Rewards points as cash back, the value of each point falls to $0.005 or the equivalent of 0.5% cash back.

Q: How do you redeem MBNA Rewards points?

Points must be redeemed by signing into the MBNA Rewards website or by contacting MBNA over the phone at 1-877-877-3703 for travel and merchandise redemptions or 1-888-876-6262 for cash back redemptions. When redeeming for travel, you can redeem points for flights on almost any airline, but using fewer than 10,000 points will result in an additional booking fee of $29 (you won’t be hit with this fee if you redeem at least 10,000 points). Here’s an overview of what MBNA points can be redeemed for:

- Travel-related purchases including flights.

- Merchandise from the MBNA Rewards catalogue from brands including Apple, GoPro, Nest, Bose, Le Creuset, Fossil, and Swarovski.

- Gift cards from dozens of merchants including Starbucks, The Keg, Hudson’s Bay, Canadian Tire, Cineplex, Home Depot, Saks Fifth Avenue, Best Buy, Sport Chek, Winners, HomeSense, and Marshalls.

- Credits that can be applied towards your monthly statement balance.

- Purchases made through the MBNA Rewards eMall.

Q: Do MBNA Rewards points expire?

A: There is no expiration date for MBNA Rewards points while you’re an active member in good standing.

Q: Can MBNA Rewards points be used to pay for taxes and fees?

A: Yes, MBNA points can be used to cover the cost of taxes, fees, and flight surcharges.

Q: Can MBNA Rewards points be used retroactively?

A: Yes, flight tickets can be purchased outright through an MBNA credit card and redeemed with points at a later date. Note, however, this option may impact the value of your points.

Q: Which airlines are involved in the MBNA Rewards program?

A: MBNA Rewards points can be redeemed for flights on the airline of your choice.

Q: Can you transfer MBNA Rewards points?

A: Unfortunately, you can’t transfer points to other loyalty programs.

Q: What does Ratehub recommend as the best MBNA credit card?

A: The MBNA Rewards World Elite MasterCard

Card details

- $120 annual fee

- Earn 2 MBNA points (2% in travel points) on all purchases

- Receive 20,000 bonus points†† after you make at least $2,000 in eligible purchases within the first 90 days of your account opening

- Receive 10,000 bonus points†† once enrolled for e-statements within the first 90 days of account opening

- Income requirement: $80,000

Find your perfect credit card in under 60 seconds - No SIN required

Tell us a bit about yourself

Answer some questions so we can personalize our recommendations - this won't impact your credit score

Check your eligibility

We confirm your eligibility with our partner, TransUnion. This will be a ‘soft credit check’ which you can see but lenders cannot

Find your perfect matches

We show you the cards you’re most likely to want and most likely to get

Marriott Bonvoy

Marriott Bonvoy is the largest hotel loyalty program in the world. Newly-launched in 2019, Bonvoy was borne out of the merger of three different hotel programs: Marriott Rewards, Starwood Preferred Guest, and Ritz-Carlton Rewards. Bonvoy points can be earned and redeemed at over 7,000 hotel locations and two-dozen hotel chains worldwide.

Q: How do you earn Mariott Bonvoy Points?

A: With the Marriott Bonvoy Card from American Express, you can earn Bonvoy points on all your everyday purchases. This credit card offers 2 points for every $1 in purchases and 5 points per $1 spent at any of the 7,000 hotels under the Marriott International brand. The card also comes with a welcome bonus of 50,000 points that can be redeemed for up to three free nights at select hotels.

You can also earn Bonvoy points without the aforementioned co-branded credit card by simply signing up for a Bonvoy account. But by going this route, you’ll only earn points when you book a stay at an eligible Marriott hotel.

Q: How much is a Bonvoy point worth in dollar value?

A: According to our calculations, the overall dollar value of 1 Bonvoy point is approximately $0.0117 when redeemed for hotel stays.

When booking hotels using points, it’s important to note that point values are not consistent and fluctuate based on three key factors: 1.) Whether you’re booking a hotel stay during peak, off-peak or peak hours, 2.) in which region of the world you’re booking a hotel, and 3.) the category of hotel you’re staying at. The Bonvoy program currently categorizes hotels into seven different tiers, with hotels in “Category 1” requiring the least amount of points per-night and “Category 7” requiring the most.

Numerous factors determine whether a hotel falls in Category 1 or 7, including the hotel’s popularity, exclusivity, location, average room rate, and more.

Q: How do you redeem Bonvoy points?

A: Bonvoy points can be redeemed for free overnight stays at Marriott International’s worldwide network of 7,000 hotels and two-dozen hotel brands, which include Marriott, Delta Hotels, Sheraton, Meridian, and St. Regis, to name a few. Hotel redemptions can be made through the Marriott website, or on the spot at any Marriott International hotel for anything that can be charged to a room.

Bonvoy members can also use their points towards flights or car rentals using Marriott’s Travel Booking website service or by transferring their Bonvoy points to any one of Marriott’s 40 airline partners.

Bonvoy points can also be redeemed for gift cards, vacation packages, and what are known as Marriott Bonvoy Moments, which includes access to concert tickets and backstage passes, as well as VIP sporting experiences and numerous other events.

As a Bonvoy member, you don’t have to rely solely on your points when redeeming for hotels or flights, as you have the flexibility to use a combination of Bonvoy points and cash. For example, Category 1 hotels during off-peak hours usually cost 7,500 points per night but can be redeemed for 3,500 points + $55 per night. The exact ratio of points to cash varies between the seven hotel categories.

Lastly, you can join forces with another Bonvoy member by pooling your points together for a single redemption.

Q: Do Bonvoy points expire?

A: Points don’t expire for active Bonvoy members but do expire for inactive accounts.

A Bonvoy account is considered inactive if, over a 24 month period, the Bonvoy member hasn’t earned or redeemed points, stayed in a participating-Bonvoy hotel or if the account has been cancelled.

Q: Can Bonvoy points be used to pay for taxes and fees?

A: Yes.

Q: Can Bonvoy points be used retroactively?

A: No, unfortunately, points can only be redeemed at the time you’re booking your hotel, flight or rewards, or when staying at a Marriott property.

Q: Can you transfer Bonvoy points?

A: Yes, Bonvoy points can be transferred to the loyalty programs of over 40 airlines, including Aeroplan miles, Emirates Skywards, Air China Companion, American Airlines AAdvantage, and more. In the case of most airlines, Bonvoy points can be transferred at a ratio of 3-to-1.

Q: What does Ratehub recommend as the best Bonvoy credit card?

A: The Marriott Bonvoy Card from American Express.

Card details

- Annual fee: $120

- Earn 5 points in eligible Card purchases at participating Marriott Rewards hotels and 2 points on all other purchases

- Welcome Bonus: 50,000 points when you make $1,500 in purchases in the first 3 months

- Automatic Marriott Bonvoy Silver Elite Status

Meridian Travel Rewards

Meridian Travel Rewards is the official rewards program of Meridian, Canada’s third-largest credit union.

Q: How do you earn Meridian Rewards points?

A: While the majority of Meridian credit cards are cash back cards, Meridian does issue two personal credit cards that offer travel points on your everyday purchases.

The Meridian Visa Infinite Travel Rewards Card offers 3 points for $1 spent in foreign currencies and 1.5 points per $1 on all other purchases but is accompanied by a $99 annual fee. The Meridian Visa Platinum Travel Rewards Card, on the other hand, has a $50 annual fee and offers 2 points for $1 spent in foreign currencies and 1 point per $1 on everything else. It’s important to note that neither of these cards are available in the province of Quebec.

Q: How much is a Meridian Rewards point worth in dollar value?

A: The value of 1 Meridian Rewards point is approximately $0.01 when redeemed for travel. Points have a lower value when redeemed for non-travel rewards, like cash back or gift cards.

Q: How do you redeem Meridian Rewards points?

A: Points can be redeemed through the Meridian Travel Rewards website for:

- Flights on more than 100 airlines, stays at more than 80,000 hotel properties, cruises and vacation packages

- Thousands of merchandise items across categories such as appliances, electronics, beauty, fitness and sports, toys and games, home, office products and outdoor living. Brands include Apple, Bose, Samsung, Dyson, KitchenAid, Le Creuset, Hudson’s Bay, Swarovski, Pandora, and FitBit.

- Gift cards from merchants including Cineplex, Indigo, Pottery Barn, Roots, Winners, HomeSense, Marshalls, Red Lobster, The Keg, Earl’s Restaurant and Jack Astor’s.

- Tickets to sporting events, live concerts, theatre, opera and comedy, motorsports, horse racing, theme park tickets, Las Vegas shows, and other special events.

Q: Do Meridian Travel Rewards points expire?

A: No, Meridian points do not expire. However, if you voluntarily choose to close your account with Meridian, your points will be forfeited immediately.

Q: Can Meridian Travel Rewards points be used to pay for taxes and fees?

A: Yes.

Q: Can Meridian Travel Rewards points be used retroactively?

A: Yes, you can redeem points as cash back to cover the cost of your rewards at a later date. The one caveat to consider is that the value of your points will be affected when using this redemption option.

Q: Which airlines are involved in the Meridian program?

A: Meridian Rewards points can be redeemed for flights on over 100 airlines.

Q: Can you transfer Meridian Rewards points?

A: Unfortunately, points cannot be transferred to other loyalty programs. That said, points can be transferred from one Meridian account holder to another.

National Bank Points

National Bank is the sixth-largest bank in Canada and the single-largest bank in Quebec.

Q: How do you earn National Bank points?

A: National Bank issues a number of credit cards that offer points on everyday purchases. Most National Bank credit cards offer between 0.5 and 2 points for every $1 spent, depending on the card and the type of purchase being made.

Q: How much is a National Bank point worth in dollar value?

A: The value of 1 National Bank point is approximately $0.01 (1%) when redeemed for travel through National Bank’s A la carte Rewards travel agency, or between 0.83% and 0.91% when you use points for travel as a statement credit.

Q: How do you redeem National Bank points?

A: Points can be redeemed through the A la carte Rewards Boutique website (which offers access to every major airline and travel agency) and can be used to cover either the full or partial cost of a travel expense. The redemption process requires that cardholders first purchase their flight tickets on their credit card and wait 72 hours before their rewards are applied to their statement. While A la carte Rewards Boutique lets you book flights from almost any airline, it doesn’t offer price matching.

If you can hunt for cheaper flight options or prefer not using the A la carte agency, you do have the ability to redeem your points for travel as a statement credit. Though, you’ll have to redeem your points for less value this way.

Aside from using points to book travel tickets, National Bank points can also be redeemed for:

- Hundreds of items from the À la carte boutique from brands including Apple, Cuisinart, Coleman, Le Creuset, LG, Bose, Michael Kors, Fossil, Oakley and, Swarovski.

- Gift cards from dozens of merchants including Hudson’s Bay, Gap, Brault & Martineau, SAQ, Club Piscine, Gap, Banana Republic, The Keg, Indigo, and Home Depot.

- Credits to pay off your credit card balance or contribute to National Bank financial products, such as TFSAs or RRSPs.

- Donations to a charity.

Q: Do National Bank points expire?

A: Points don’t expire as long as your National Bank account is in good standing.

Q: Can National Bank points be used to pay for taxes and fees?

A: Yes, points can be used to cover fees.

Q: Can National Bank points be used retroactively?

A: Yes, on National Bank Platinum, World and World Elite credit cards, points can be used retroactively. Cardholders must first purchase the flight tickets on their credit card and request to exchange their points for a travel discount from National Bank within 60 days of the transaction.

Q: Which airlines are involved in the National Bank A la carte program?

A: National Bank points can be redeemed for flights on multiple airlines.

Q: Can you transfer National Bank points?

A: National Bank points cannot be transferred to other loyalty programs. However, points can be transferred from one National Bank account to another.

RBC AVION

Avion is the travel rewards program of RBC – the largest of Canada’s big six banks based on assets and market capitalization. RBC Avion points can be redeemed for travel rewards including flights, hotels, and car rentals. Ticking off all the boxes of a flexible travel program, Avion members can book flights on any airline with no seat restrictions or blackout dates.

Q: How do you earn RBC Avion points?

A:RBC credit cards that are affiliated with the Avion program offer 1 point for every $1 in purchases, and up to 1.25 points for every $1 spent on eligible travel purchases.

Q: What is the dollar value of an RBC Avion point?

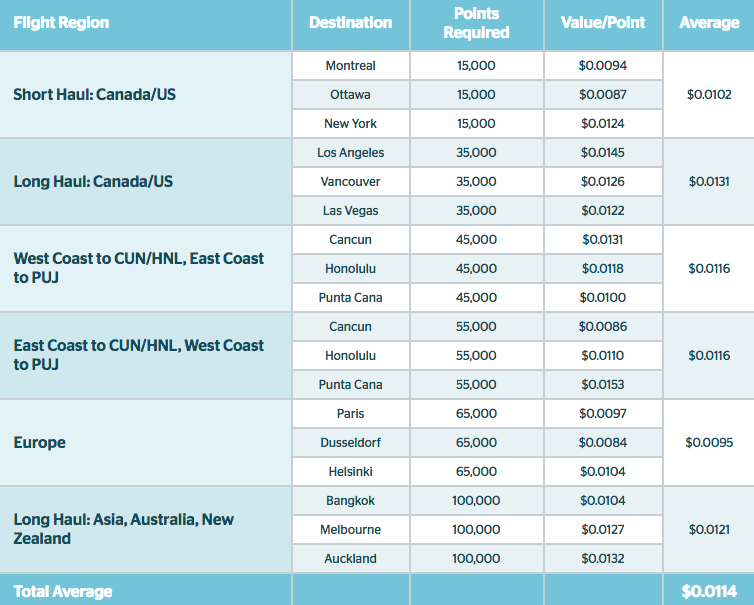

A: According to our calculations, the dollar value of 1 Avion point is approximately $0.0114 when redeemed for flights through RBC’s Air Travel Redemption Schedule. Through this Schedule, Avion points are not consistent and their exact value can fluctuate based on which of the six RBC flight zones (outlined in the table below) you’re travelling to and the total cost of the flight.

Avion points can also be redeemed for travel without the Air Travel Redemption Schedule at a rate of 100 points per $1 (the equivalent of 1%).

Q: How do you redeem RBC Avion points?

A: RBC Rewards points can be redeemed through the RBC Rewards website.

When redeeming your points for flights, you can use RBC’s Air Travel Redemption Schedule to take advantage of special rates available exclusively to Avion cardholders.

This Schedule uses a chart system where each travel destination has a required number of points that can be redeemed for a flight up to a “Max Ticket Price”.

Let’s look at an example: to fly to Mexico, you’ll need no less than 45,000 Avion points. You can redeem these points for a flight up to a “Max Ticket Price” (that’s $900 in the case of Mexico). If you need to redeem for a flight that’s over the “Max Ticket Price”, you can top off the difference by redeeming points at a rate of $0.01 each (the equivalent of 1%). Depending on the price of the ticket and flight destination, using the Air Travel Redemption Schedule will mean you can redeem fewer points per flight, letting you stretch their dollar value. It’s worth noting you can only use this Schedule for round-trip flights mostly out of Canada.

You can also redeem Avion points without the Schedule for all travel-related rewards (including one-way flights and hotels) at a fixed rate of 100 points for 1 dollar (or $0.01 / 1%).

TIP:

- You’ll want to run the numbers when deciding which of these two travel redemption options is more cost-effective. In general though, you’ll get better value from the Air Travel Redemption Schedule the closer a flight ticket is to the “Max Ticket Price.”

Aside from travel, Avion points can be redeemed for numerous other rewards including:

- Hotels, car rentals, vacation packages, and cruises.

- For thousands of items from Apple and Best Buy catalogues, as well as household and fashion merchandise, and gift cards.

- As credits to be applied to your credit card balance, RBC loans or investment products.

TIPS:

- To get the most value out of your points, stick to using your Avion points for flights. Merchandise and non-travel redemptions typically offer less value for your points.

Q: Do RBC Avion points expire?

A: Avion points do not expire for active members. If you choose to voluntarily close your account, however, you will have 90 days to redeem your Avion points before they are forfeited.

Q: Can Avion points be used to pay for taxes and fees?

A: Yes, points can be applied to the cost of taxes and fees at a rate of $0.01 per point.

Q: Can you transfer Avion points?

A: Compared to the rewards programs of some other Canadian banks, Avion points can be transferred to a number of popular frequent flyer programs including West Jet, British Airways, HSBC, and American Airlines.

SCENE

The loyalty program of choice for movie buffs, SCENE is jointly owned by Scotiabank and Cineplex Entertainment and offers points that can be redeemed for free movie tickets and concession-stand purchases at over 160 theatres across Canada.

Q: How do you earn SCENE points?

A: You can earn SCENE points in one of two ways: with a SCENE membership card or a Scotiabank SCENE Visa Card.

With a SCENE membership card, you’ll only earn points on purchases made at Cineplex Cinemas or partner store locations. This membership card offers between 125 to 250 SCENE points for every Cineplex movie ticket purchase (depending on the type of movie ticket, i.e. 3D versus VIP) and 5 points for every $1 spent at the concession stand or on the online Cineplex store.

On the other hand, if you have a Scotiabank SCENE credit card, you’ll get SCENE points on all your everyday expenses – not just those that are Cineplex-related.

Plus, with a SCENE Visa Card, you’ll earn SCENE points at a faster rate, as you’ll get 5 points per $1 spent at Cineplex Cinemas (including at the concession stand) and 1 point per dollar on all your other non-Cineplex related purchases.

TIPS:

- You can earn considerably more bonus points at the concession stand when buying combos, as opposed to individual snacks or food items.

Q: What is a SCENE point worth in dollar value?

A: The dollar value of 1 SCENE point hovers between $0.0085 and $0.0136, depending on what type of movie ticket you’re redeeming for.

For concession-stand purchases, like snacks and drinks, SCENE points have a fixed redemption value of $0.01 or 1%.

TIPS:

- Every Tuesday, Cineplex offers movie tickets at a discounted price. Since ticket prices are already reduced, avoid using your SCENE points on Tuesdays, and instead, save up your points for another day of the week when you can redeem them for a full-priced ticket.

- You can use the SCENE app or website to check your points balance and view special offers that allow you to either earn bonus points on purchases or redeem rewards for half the usual number of points.

- If you’re looking to catch a movie at home that’s not available on your favourite streaming service, consider using the online Cineplex Store. You can earn bonus SCENE points on all your online movie and television purchases from this digital platform.

Q: What can I redeem SCENE points for?

A: SCENE is a straight-forward rewards program that allows you to redeem points for free movie tickets (and concession-stand food and drinks) from Cineplex Cinemas by simply presenting your SCENE Visa Card at the checkout counter.

Below, we’ve broken down how many SCENE points you need to redeem for free movie tickets, and more:

- 500 points for $5 off concession-stand purchases

- 1,250 points for a general admission movie ticket (regular or 3D screening)

- 2,000 points for an enhanced movie ticket (Ultra AVX, D-BOX, IMAX)

- 2,500 points for a VIP movie ticket

Additionally, you can redeem points for discounted meals and purchases from a select number of SCENE partner locations, including Swiss Chalet, Montana’s, East Side Mario’s, Bier Market, and Rec Room.

Q: Do SCENE points expire?

A: SCENE points don’t expire as long as your account is active and in good standing. But, SCENE points will expire if your SCENE Visa card or points go unused for two consecutive years.

Q: Can SCENE points be used to pay for taxes and fees?

A: Yes, SCENE points can also be applied to the additional cost of taxes and fees on movie ticket purchases.

Q: Can you transfer SCENE points?

A: You can convert SCENE points to Scotia Rewards points, Scotiabank’s branded rewards program.

Q: What does Ratehub recommend as the best SCENE credit card?

A: The Scotiabank Scene Visa Card.

Card details

- Annual Fee: $0

- Earn 5 Scene points for every $1 spent at Cineplex Theatres

- 19.99% annual interest rate

Scotia Rewards

Scotia Rewards is the branded rewards program of Scotiabank, the third largest of Canada’s big six banks based on profitability. The flexible rewards program offers points that can be redeemed for everything from flights (on any airline with no blackout periods) to free hotel stays, merchandise, and more. Scotia Rewards members also have access to Scotiabank’s full-fledged travel service and price match guarantee that allows for a streamlined travel booking experience.

Q: How do you earn Scotia Rewards points?

A: You can earn Scotia Rewards points on a per-dollar basis through any of the Scotiabank credit cards that are affiliated with the Scotia Rewards program. Depending on the card and the type of purchase, you can get between 1 and 4 points for every dollar you spend.

Q: How much is a Scotia Rewards point worth in dollar value?

A: The dollar value of 1 Scotia Rewards point is $0.01 when redeemed for travel. Scotia Rewards point values are fixed and do not fluctuate based on the flight destination.

Q: How do you redeem Scotia Rewards points?

A: You can start redeeming points for travel rewards when you’ve accrued at least 5,000 points ($50 value), with additional redemptions only accepted in increments of 5,000 points.

When it comes to using points for flights or hotels, you can either redeem points from the Scotia Rewards website or from any airline or third-party travel agency (flexibility is one of this program’s biggest perks).

You can also visit the Scotia Rewards website to redeem points for merchandise (from brands including Amazon, Cineplex, Hudson’s Bay, Indigo and more), gift cards, as well as credits to help pay off your credit card statement. However, it’s worth noting these redemption options offer far less value for your points compared to when they’re redeemed for travel.

TIP:

- Read our blog post on How the Scotia Rewards Program Works for an-depth review of this loyalty program.

Q: Can Scotia Rewards points be used retroactively?

A: Yes, flight tickets can be purchased outright through a Scotiabank rewards credit card and conveniently redeemed using points at a later date. You’ll be credited for retroactive redemptions 7 to 10 days from the date of your purchase.

Q: Which airlines are involved in the Scotia Rewards program?

A: Scotia Rewards points are flexible and can be redeemed for flights on the airline of your choice.

Q: Can you transfer Scotia Rewards points?

A: Yes, Scotia Rewards can be transferred between Scotia Rewards-linked accounts as well as within the Scotiabank SCENE program.

Q: What does Ratehub recommend as the best Scotiabank credit card?

A: The Scotiabank Gold American Express.

Card details

- Annual fee: $99

- Earn 4 Scotia Rewards points per dollar on gas, groceries, entertainment, and restaurants; earn 1 point per dollar on all other purchases

- Until June 30, 2019: Earn 15,000 bonus points (value: $150) when you make $1,000 in everyday purchases in the first 3 months

- Discounted membership to Priority Pass airport lounges worldwide

Find your perfect credit card in under 60 seconds - No SIN required

Tell us a bit about yourself

Answer some questions so we can personalize our recommendations - this won't impact your credit score

Check your eligibility

We confirm your eligibility with our partner, TransUnion. This will be a ‘soft credit check’ which you can see but lenders cannot

Find your perfect matches

We show you the cards you’re most likely to want and most likely to get

TD Rewards

TD Rewards is the branded rewards program of TD Bank, the country’s second-largest bank according to both assets and market capitalization. The popular rewards program offers a flexible points structure, in which points can be redeemed for flights on almost any airline (with no blackout dates) as well as hotels, cruises, merchandise, and more. TD Rewards cardholders can also earn additional points when booking their travel plans through Expedia (known as the ExpediaforTD service).

Q: How do you earn TD Rewards points?

A: There are a total of three TD credit cards that are associated with the TD Travel Rewards program. Depending on the card and the type of purchase you make, you can earn anywhere from 1 to 9 points for every $1 you spend.

TIPS:

- If you’re a TD Rewards cardholder, you can earn up to triple the points when booking travel through the ExpediaforTD website. Therefore, you should always aim to use this service for your travel-related purchases instead of buying tickets directly from an airline or another third-party travel agency.

- Since you can book flights from any airline through Expedia, you can double dip and earn points on both your TD credit card and the loyalty card of your favourite airline.

- One of the best ways to maximize how many TD points you can earn is by picking a card that rewards you the most points for your everyday purchases. That’s why we recommend the TD First Class Travel Visa Infinite*. This card offers 9 points per dollar on the ExpediaforTD website, and 3 points per dollar on all other purchases.

Q: How much is a TD Rewards point worth?

A: According to our calculations, the value of 1 TD Rewards point is approximately $0.005 when redeemed for travel through the ExpediaforTD service. The value of points are lower when they’re used for gift cards or travel not booked through ExpediaforTD.

Q: How do you redeem TD Rewards points?

A: You can start redeeming points through Expedia when you’ve accrued at least 200 points or 250 points in instances when you’re not leveraging Expedia’s partnership with TD.

TD points can be redeemed for a variety of travel-related expenses (including flights, train and bus tickets, car rentals, cruises, hotels, tours, and more). You have the flexibility to book travel through the ExpediaforTD service (online or over the phone), or on your own by applying points for the cost of any travel expense charged to your card.

You can also redeem TD Rewards points for items from the merchandise catalogue, which has one of the widest selections available with access to thousands of items across numerous shopping categories including electronics, entertainment, home and garden items, fashion accessories, luggage and travel, health and beauty, games and toys, as well as baby products from almost every name brand imaginable.

Additionally, you can redeem points for gift cards from dozens of retailers and restaurants including Boston Pizza, Moxie’s, Starbucks, The Keg, Apple, Cineplex, Costco, Loblaws, Longos, Hudson’s Bay, Indigo, Gap, Roots, Sephora, Canadian Tire, Winners, HomeSense, and Marshalls.

Q: Do TD Rewards points expire?

A: Points do not expire as long as your account is open. If you voluntarily choose to close your account, however, you have up to 90 days to redeem your points before they are forfeited.

Q: Can TD Rewards points be used to pay for taxes and fees?

A: Yes, TD Rewards points can be used to cover the full cost of taxes and fees.

Can TD Rewards points be used retroactively

A: Yes, you can apply TD points to travel purchases retroactively by requesting for a credit from TD no later than 90 days from the date of your ticket purchase. However, this does not apply to purchases made through ExpediaforTD. Since Expedia offers a considerably higher number of TD Rewards points on your travel-related purchases, you’ll want to leverage Expedia as much as possible.

Which airlines are affiliated with the TD Rewards points program?

A: TD Rewards points can be redeemed for flights on the airline of your choice.

Can TD Rewards points be transferred to other loyalty programs?

A: Unfortunately, not.

Q: What does Ratehub recommend as the best TD credit card?

A: The TD First Class Travel Visa Infinite*.

Card details

- Annual fee: $120 (waived for the first year)

-

Earn up to 80,000 TD Points† plus 0% promotional interest rate on travel purchases for the first 6 months†. Conditions Apply. Must apply by March 6, 2022

- Earn 9 TD Points per $1 on travel through ExpediaforTD

- Earn 3 TD Points per $1 on everything else

- This offer is not available for residents of Quebec.

Triangle Rewards

Triangle Rewards is the newly-revamped rewards program from Canadian Tire – one of the country’s largest department stores and a pioneer of store loyalty programs, having launched Canadian Tire Money back in 1958. Triangle Rewards offers the ability to earn and redeem your Canadian Tire Money electronically and is an ideal option for anyone who frequently visits Canadian Tire as part of their household shopping runs.

Q: How do you earn Canadian Tire Money through Triangle Rewards?

A: You can earn Canadian Tire Money through Triangle Rewards in one of two ways: by signing up for a basic Triangle Rewards membership or by applying for one of two Canadian Tire credit cards.

As a basic Triangle Rewards member, you’ll earn 0.4% in Canadian Tire Money for every dollar you spend at Canadian Tire, Sport Chek, Marks, and Atmosphere.

With a Triangle Mastercard credit card, however, you’ll earn 4% in Canadian Tire Money at Canadian Tire (and its affiliate stores) and 0.8% on all your purchases everywhere else.

Q: How much is Canadian Tire Money worth?

A: 1% in Canadian Tire Money is equal to $0.01.

Q: How do redeem Canadian Tire Money through Triangle Rewards?

A: Canadian Tire Money can only be redeemed at the following locations: Canadian Tire, Sport Chek, Mark’s/L’Équipeur, and Atmosphere. You can redeem your Canadian Tire Money to your purchases through either the Triangle Rewards membership card, app, or keyfob.

Triangle Rewards members can also take advantage of additional perks, such as the ability to make returns without a receipt, receive personalized offers through the Triangle App, and track their transaction history and Canadian Tire Money balances.

Q: Does Canadian Tire Money expire?

A: Canadian Tire Money does not expire.

Q: Can Canadian Tire Money be used to pay for taxes and fees?

A: Yes, Canadian Tire Money can be used to cover taxes on select purchases.

Q: Can you transfer Canadian Tire Money?

A: Unfortunately not.