What is a Private Mortgage?

This post was first published on October 28, 2013, and was updated on March 30, 2023.

For mortgage borrowers who have a hard time paying down their existing mortgage, or don’t have the required income or credit score to qualify for a new one, there are options. One is a second mortgage, which is an additional loan taken out on a property that is already mortgaged. Another is a private mortgage, which is home financing provided via an individual or group of investors, rather than a traditional bank.

Private mortgages have emerged as an alternative for borrowers who don’t meet the conservative lending guidelines used by banks and other lenders in Canada; these exclude many individuals who are in fact able to repay the money they borrow, but may have poor credit, or an unconfirmable source of income. If you’ve been turned away by a traditional lender for any reason, a private lender is often willing to look beyond your credit history to see how they can help you get the money you need – fast.

What is a private mortgage?

A private mortgage is a short-term, interest-only loan that is often taken out by someone who doesn’t qualify for prime or bad credit lending. Private mortgages have an average amortization of 1-3 years, during which time the borrower only pays off the interest accumulated each month; at an annual rate of 10-18%, the payments aren’t cheap. At the end of the term, most homeowners transfer their mortgage to a traditional lender.

Why would a homebuyer get a private mortgage?

There are a number of reasons a homebuyer might take out a private mortgage:

- You want to purchase an unconventional property that a prime lender won’t finance.

- Your bad credit history means you’re being turned away by traditional lenders.

- You need money now and don’t want to wait for a long approval process (some private mortgage brokers can have the money in your hands in just a few days).

- You can’t confirm your income, which is preventing you from being able to get a traditional mortgage.

- You only need a short-term loan.

How are private mortgages different from traditional mortgages?

There are four major differences between private mortgages and traditional mortgages:

- Amortization – Terms often range between 1-3 years, but some private mortgage lenders may offer long-term solutions with amortizations up to 35 years.

- Interest Rate – While conventional mortgages come with some of the best mortgage rates on the market, private mortgage interest rates range between 10-18%. Remember that private mortgages are often used as a last resort when prime and bad credit lenders have deemed the buyer to be a high risk. Someone with a higher risk often has to pay a premium (in this case, a higher mortgage rate) to borrow money.

- Payments – With a conventional mortgage, your monthly mortgage payments go towards both your principal and the interest. With a private mortgage, only the interest is repaid, while the principal never goes down.

- Fees – On top of your monthly interest payments, if you used the help of a mortgage broker to get a private mortgage, you may need to pay a commission to the broker. You’ll also be responsible for paying any of the setup fees. In the end, you could end up paying as much as 1-3% of the loan amount in extra fees.

How is a private mortgage calculated?

Let’s look at one example: John Smith wants to borrow $400,000 to buy a property that the banks won’t approve him for. A private lender decides to lend John the money via a private mortgage. John borrows the $400,000* at a 10% interest rate over a 2-year term. His monthly interest-only payment would be calculated as:

10% / 100 = 0.1

Monthly interest: 0.1 / 12 months = 0.00833

Monthly payment: $400,000 x 0.00833 = $3,332

Interest over term: $3,332 x 24 months = $79,968

At the end of the 2-year term, John will pay the private lender a total of almost $80,000 of interest. If all goes well, John could then try to transfer the $400,000 private mortgage over to a traditional lender, so he could finally start paying down the principal.

*If there were setup fees and/or a broker commission, they would tacked onto the $400,000 amount John needed to borrow. For this example, we kept the numbers simple and did not add any extra fees.

Which lenders offer private mortgage loans?

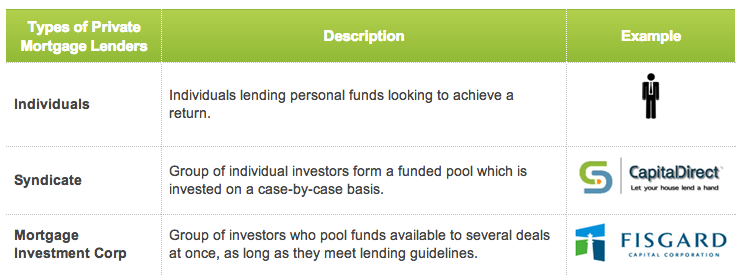

Traditional banks don’t offer private mortgage loans. Instead, private mortgages are offered by a combination of individuals, syndicates and mortgage investment corporations. The chart below explains how each type of lender gets its money and chooses to lend it out.

What do I need to quality for a private mortgage?

Because private mortgages are considered risky for the lender, they are subject to tight guidelines and restrictions. Private mortgage lenders do a great deal of research, to determine whether or not the buyer is a good candidate for a private mortgage.

You must have the following items in order to qualify for a private mortgage:

- A sellable property – Because private mortgages are unsecured, the lender must be able to take possession of / sell a property if the buyer defaults on their payments. The property should be in good condition and be located in an in-demand area.

- Proof of income – Private mortgage lenders prefer that you have confirmable income (income that can be proven), but this is not always possible. If you are self-employed, income is not always confirmable. In this case, an estimate is used and additional documents supporting your income must be provided.

- Down payment – With a private mortgage, the minimum down payment you must put towards the purchase of a new property is 15% of the purchase price.

As you can see, a private mortgage is often a last resort option for people who don’t qualify for prime or bad credit lending. If you need money fast and can afford to make the interest-only payments, a private mortgage could be a great way for you to purchase another property or another large expenditure. However, it’s important to remember how high the interest rates are, in comparison to those that come with traditional mortgages. If you want to find out if a private mortgage is a financing option for you, find a mortgage broker in your area that you can speak to.

Also read: